Good Sunday Morning! Yet another glorious day, a streak that is increasingly destined to end. If you are stuck indoors today, well then we have some items for your reading pleasure:

• Lowenstein: The Federal Reserve’s Framers Would Be Shocked (NYT) see also Markets Might Be Misreading Fed’s Messages (Real Time Economics)

• 7 mutual fund ads you’ll never see (Marketwatch)

• China’s economy is freezing up. How freaked out should we be? (Washington Post) see also All About the Maos: Charting China’s Cash Crunch (China Real Time)

• Martin Wolf: How Austerity Has Failed (NYRB)

• Is Mark Zuckerberg the new Bill Gates? (pandodaily)

• Bank of America’s Foreclosure Frenzy (Bloomberg)

• Going Dutch — Could Fee Hurdles Come Down Everywhere? (WSJ/Moneybeat)

• Booz Allen, the World’s Most Profitable Spy Organization (Businessweek)

• Why Tesla Thinks It Can Make Battery Swapping Work (MIT Technology Review)

• Take It Outside (WSJ)

Whats for brunch?

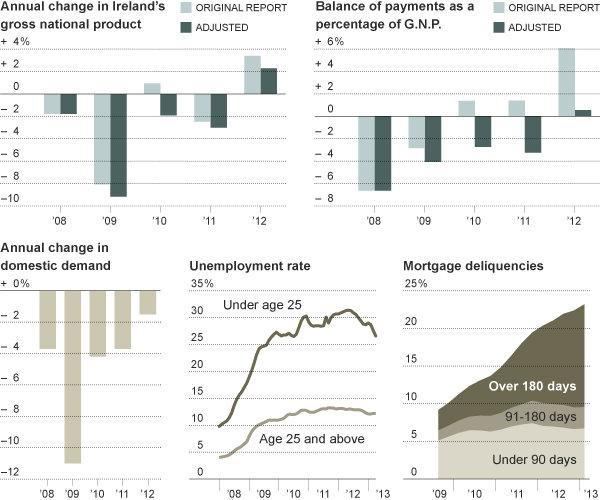

Ireland’s Not So Rosy Turnaround

Source: NYT

What's been said:

Discussions found on the web: