My morning reads:

• The Fed begins its long and gradual exit (FT.com)

• GMO’s Montier on Why to Hold Cash (Advisor Perspectives)

• Wolfers: Markets Have Already Misread the Fed (The Ticker) see also More easy money’s on the way (New York Post)

• Emerging Markets Crack as $3.9 Trillion Funds Unwind (Bloomberg)

• Bond Bull Market Isn’t Dead Yet, Longtime Bond Bull Says (Yahoo) see also Bernanke won’t blow up bond market (Fortune)

• Embrace The Life-Building Power Of Creative Destruction (Forbes)

• Why India Trails China (NYT)

• Sizing Up Big Data, Broadening Beyond the Internet (Bits)

• How Caffeine Can Cramp Creativity (New Yorker)

• Remembering James Gandolfini and Tony Soprano (Hit Fix) see also Definitive Explanation of the End of the Sopranos (Masters of Sopranos)

What are you reading?

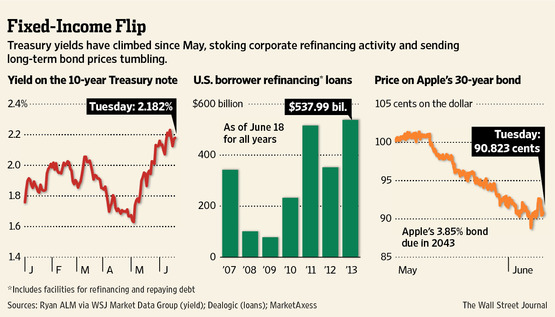

Bond Investors Head for the Hills

Source: WSJ

What's been said:

Discussions found on the web: