My afternoon train reading:

• Analysis on Tapering QE3: Will Not Happen. (Calculated Risk) see also Parsing the Fed: How the Statement Changed (Real Time Economics)

• Farrell: New China billionaires blowing massive bubbles (MarketWatch)

• MoneyBeat two-fer:

…..-It’s Not Just the Fed, It’s China, Too (Moneybeat)

…..-Gold is now only back to where it was in September 2010 (Moneybeat)

• Today’s WTF headline: GM Surges to Top of Quality Rating With Ostrich Feathers (Bloomberg)

• DeLong: The Second Great Depression (Foreign Affairs)

• Bernanke’s Bond-Buying Paradox for Markets (WSJ) see also Crossed signals over Fed’s stimulus efforts (Washington Post)

• Congress is wildly unpopular. Should anyone actually care? (Wonkblog)

• Why Monopolies Make Spying Easy (New Yorker)

• My attorney’s response to the cease-and-desist letter (Local Forums)

• Financial Sector Thinks It’s About Ready To Ruin World Again (Onion)

What are you reading

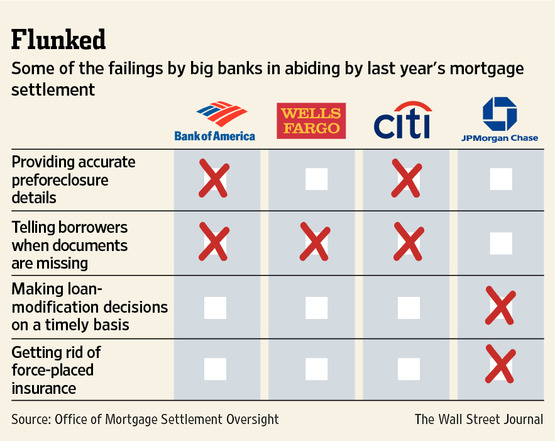

Banks Blundered on Mortgage Pact

Source: WSJ

What's been said:

Discussions found on the web: