My morning reads:

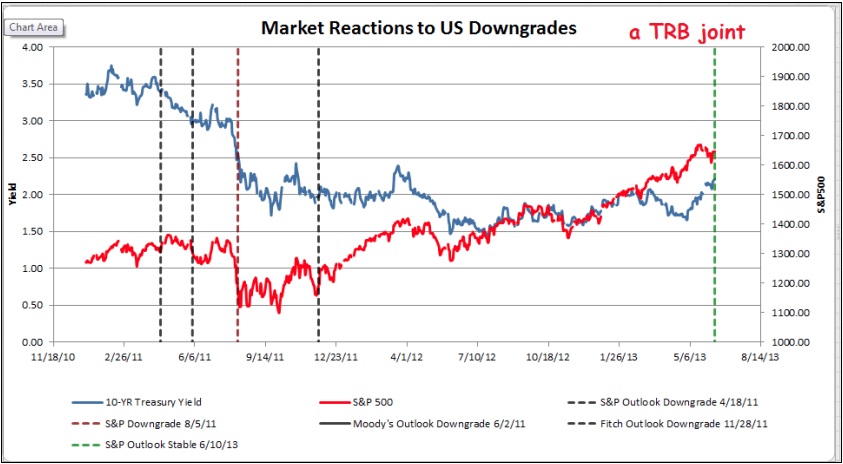

• About that whole downgrade thingie: S&P Revises U.S. Outlook to Stable (Fox) see also S&P’s Lack of Sway on Display in U.S. Move (WSJ) eejits!

• The 3 Worst Financial Predictions of the Last 5 Years (Pragmatic Capitalism)

• Is Japan already dead? (Worthwhile Canadian Initiative) see also What Abenomics tells us about the great bond market asset bubble (Telegraph)

• More proof of FINRA’s corruption: A Rise in Requests From Brokers to Wipe the Slate Clean (DealBook)

• Skyscraper Prices Head North (WSJ)

• Scaramucci Seeks Money for Manhattan Hedge-Fund Hangout (Bloomberg) see also Scaramucci Schmoozes His Way Into Funds (Bloomberg)

• Recharge Now! Tesla stock could be in trouble unless they come up with a cheaper, stronger battery (Barron’s)

• The latest finance scam: Tire Rentals (Credit Slips) see also High prices are driving more motorists to rent tires (Los Angeles Times)

• The economic case for the US to legalize all drugs (Quartz)

• ‘This Is Our Signature’: iOS 7 (Daring Fireball) see also Why iRadio Could Be a Hit for Apple and a Dud for Big Music (All Things D)

What are you reading?

It’s a good thing S&P isn’t a hedge fund

Source: The Reformed Broker

What's been said:

Discussions found on the web: