My morning reads:

• Duh: High-frequency trading tactic lowers investor profits (Phys Org)

• Quantitative easing may be most powerful when it ends (Telegraph) but see QE addiction may be hard to kick (FT.com)

• Stan Druckenmiller: ‘Do I Have A Competitive Advantage Left?’ (Moneybeat)

• FHFA Hires Insurance Lobbyist as Insurance Consultant (American Banker) see also Rigged-Benchmark Probes Proliferate From Singapore to UK (Bloomberg)

• When Stocks Move in Unison, Look Out (Barron’s) see also Second-quarter profit warnings target record (MarketWatch)

• Jubak: Next bust creeps a little closer (MSN Money) see also Dow balloon really pinata (New York Post)

• Fascinating: Trying to build a bomb that won’t blow up (Washington Post)

• Get Rid of the App Store’s “Top” Lists (Macro.org)

• The Feminist Taylor Swift Twitter Account Is Hilarious (BuzzFeed)

• Trailer Critic: The Wolf of Wall Street (Slate)

What are you reading?

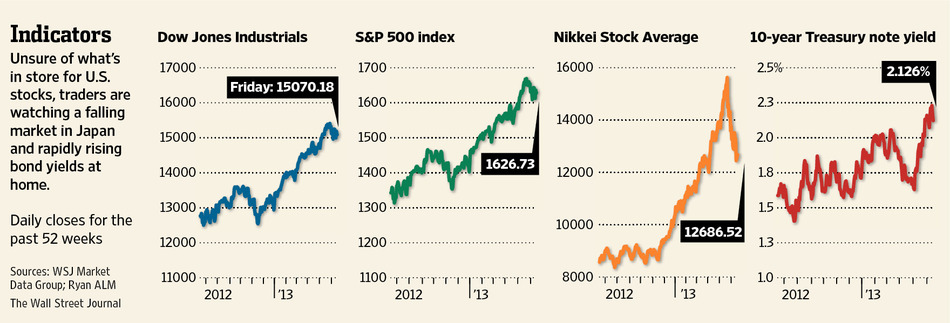

Will the Stock Market Party On? It’s All Up to the Fed.

Source: WSJ

What's been said:

Discussions found on the web: