My morning reads:

• The 8 Worst Gold Price Predictions We’ve Ever Heard (Business Insider) see also Gold Was a Horrible Investment from 1500 to 1965 (Atlantic)

• Fox Analyst Charles Payne Was Paid To Push Now Worthless Stocks (Media Matters) Are all Fox analysts paid stock touts, or just the two we know about?

• The Fed’s Real QE Mistake:Timing (Political Calculations) see also On the Failure of Ben Bernanke’s Non-Standard Monetary Policies… (Brad DeLong)

• Misjudged Annuity Guarantees May Cost Life Insurers Billions (WSJ)

• Carney’s Escape Velocity Aim Brings Canadian Halo to BOE (Bloomberg)

• The Sharpe Edifice (Research Puzzle)

• The Other Snowden Drama: Impugning the Messenger (NYT) see also U.S. Said to Explore Possible China Role in Snowden Leaks (Bloomberg)

• Exit From the Bond Market Is Turning Into a Stampede (DealBook)

• Why keeping FINRA from ruling RIAs is critical to these firms, the investor — and even the U.S. economy (RIABiz)

• Scientists create nanoscopic data storage using graphene ‘paper’ and electron ‘ink’ (Extreme Tech)

What are you reading?

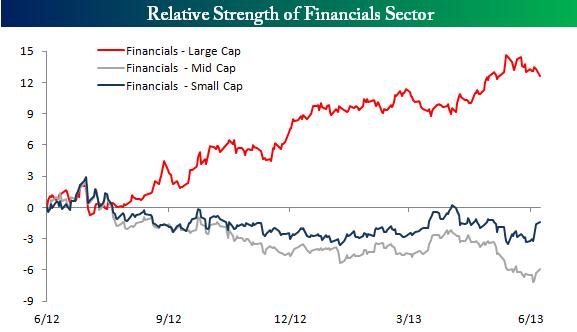

Think It’s a Level Playing Field in the Financial Sector? Think Again.

Source: Bespoke

What's been said:

Discussions found on the web: