My afternoon train reads:

• The Rally in Three Charts (Hint: It’s Not All About the Fed) (Moneybeat)

• Santoli: ‘New Abnormal’ Is the New ‘New Normal’ – but What Is It? (Yahoo Finance)

• The central bank (communications) bubble (FT Alphaville) see also Inflation Continues to Undershoot Fed Target (Real Time Economics)

• Tokyo Shares Get a Second Look (WSJ)

• Not Even ‘Googling’ Your Financial Advisor, Seriously? (CNBC)

• Hospital CEO Bonuses Reward Volume and Growth (ABC) see also The Further Adventures of the Free Market (Esquire)

• 7 Important Examples of How Markets Can Fail (Fiscal Times)

• Bartlett: How the Revival of Postwar Germany Began (Economix)

• Are Bigger Universities Better? (priceonomics)

• Gagged by Big Ag (Mother Jones)

What are you reading?

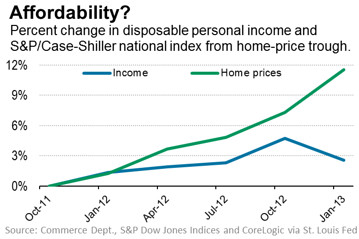

Will Home Prices Be Constrained by Stagnant Incomes?

Source: Real Time Economics

What's been said:

Discussions found on the web: