My afternoon train reading:

• Anglo Irish bankers ‘tricked’ government into bailout (Telegraph)

• Walking Back Bernanke Wished on Too Much Information (Bloomberg) see also “We are not tightening”, says a tightening Fed (Economist)

• Warming oceans make parts of world ‘uninsurable’, say insurers (FT.com)

• FINRA tries to monetize arbitrations as a business model (Bloomberg)

• There goes that manufactured controversy: IRS Look at Progressive Groups Complicates Controversy (Bloomberg)

• Secret files reveal how pay-to-play works in N.J. (NJ.com)

• My Song Got Played On Pandora 1 Million Times and All I Got Was $16.89, Less Than What I Make From a Single T-Shirt Sale! (Trichordist)

• 11 Reasons Infographics Are Poison And Should Never Be Used On The Internet Again (Business Insider)

• What is the Best Predictor of Unhappiness? (Priceonomics)

• My tennis obsession (Prospect)

What are you reading?

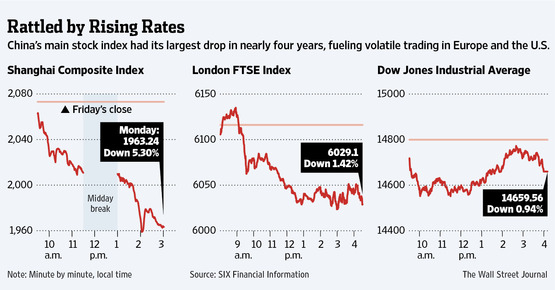

Volatility Lingers as Investors Reset

Source: WSJ

What's been said:

Discussions found on the web: