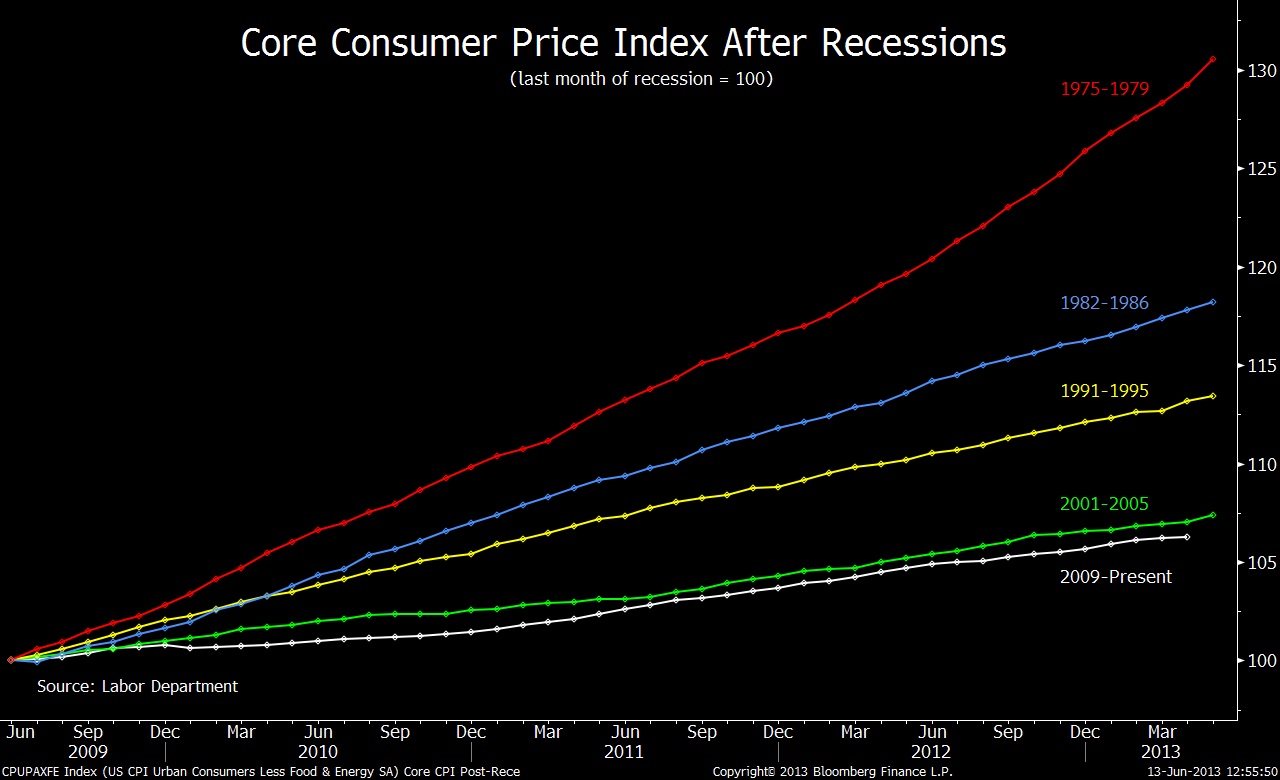

U.S. core consumer price index’s increase since the latest recession ended in June 2009

Click to enlarge

Source: Bloomberg

The amount of inflation since the end of the recession in June 2009 is the smallest for any multiyear recovery since the 1970s. The gauge of prices excluding food and energy rose 6.3% through April. Core consumer prices were 7% higher at the same point in the previous recovery, which started in December 2001, as the chart shows.

The biggest increase in the inflation gauge was 29%, posted in a recovery that began in April 1975.

The Federal Reserve may be able to take its time in adopting a more restrictive monetary policy because inflation is relatively tame.

Source:

Dormant Inflation Seen Giving Fed Time to Wait

David Wilson

Bloomberg, June 13, 2013

What's been said:

Discussions found on the web: