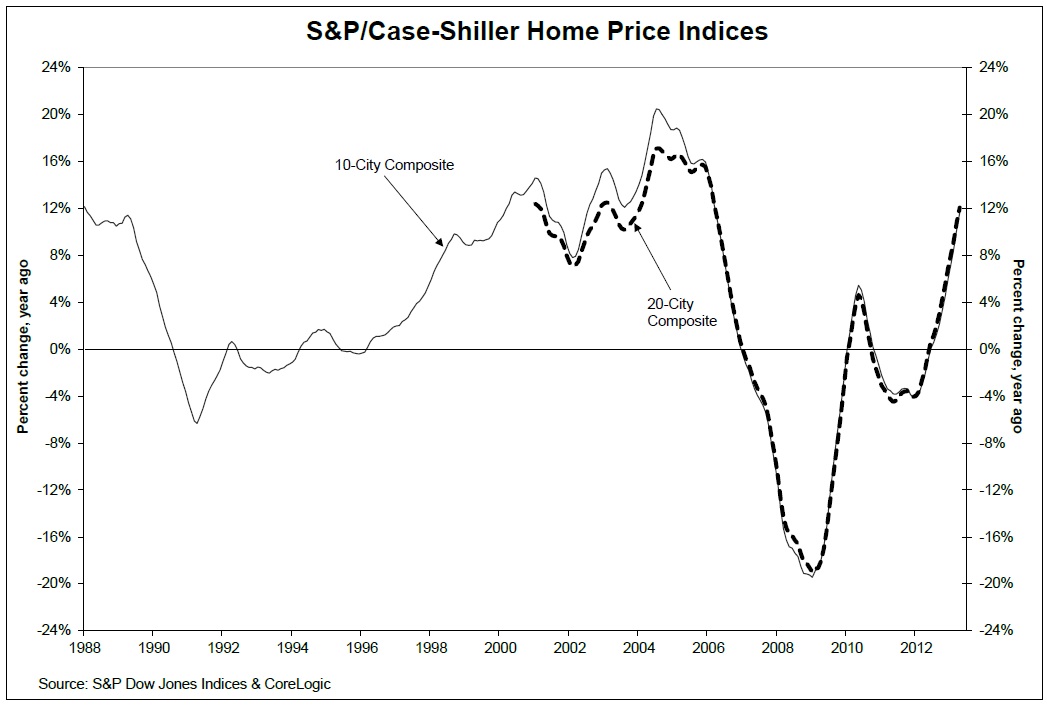

Is the Fed trying to take some air out of the Housing market?Double digit gains over the past year might have their attention:

• Average home prices increased 11.6% and 12.1% for the 10- and 20-City Composites in the 12 months ending in April 2013.

• From March to April, the 10- and 20-City Composites rose 2.6% and 2.5% respectively

• The 10- and 20-City Composites posted their highest monthly gains in the history of S&P/Case-Shiller Home Price Indices

• All 20 cities and both Composites showed positive year-over-year returns for at least the fourth consecutive month.

• On a monthly basis, all cities with the exception of Detroit posted positive change.

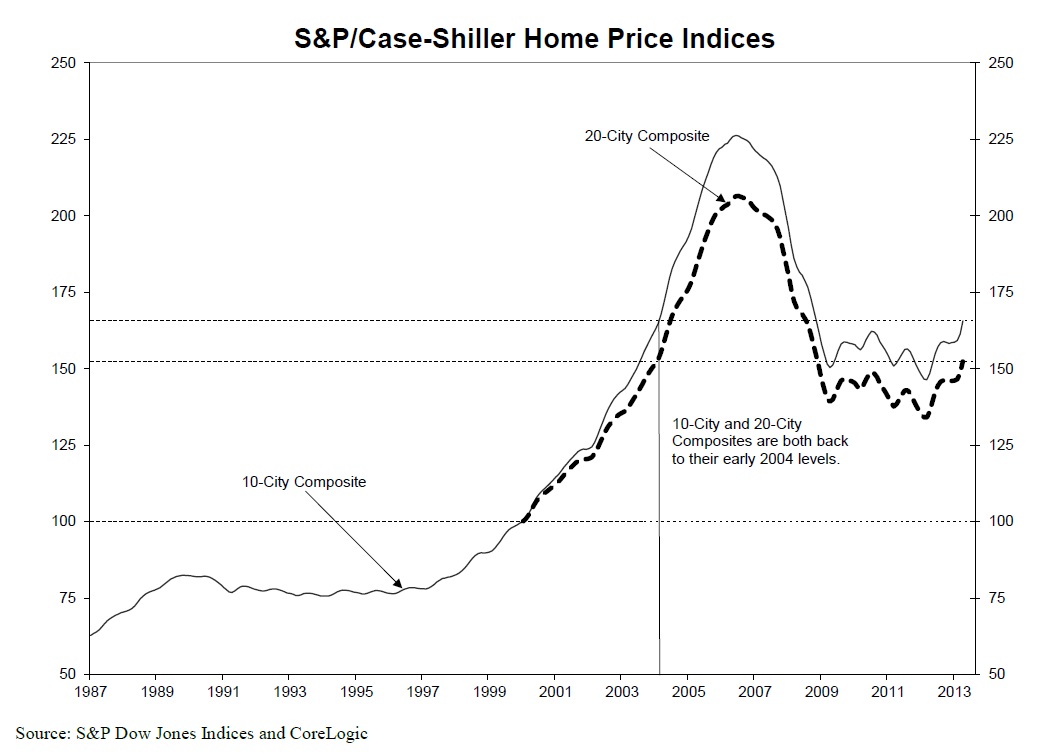

• As of April 2013, average home prices across the United States are back to their early 2004 levels for both the 10-City and 20-City Composites.

• Measured from their June/July 2006 peaks, the peak-to-current decline for both Composites is approximately 26-27%.

• The recovery from the March 2012 lows is 13.1% and 13.6%, respectively.

Charts below:

The latest results of the Case-Shiller Home Price data through April 2013:

Source:

S&P Dow Jones Indices, June 25, 2013

www.spdji.com

What's been said:

Discussions found on the web: