Drilling Down into Core Inflation: Goods versus Services

M. Henry Linder, Richard Peach, and Robert Rich

Liberty Street Economics, June 05, 2013

Among the measures of core inflation used to monitor the inflation outlook, the series excluding food and energy prices is probably the best known and most closely followed by policymakers and the public. While the conventional “ex food and energy” measure is a composite of the price changes of a large number of different products and services, almost all models developed to explain and forecast its behavior do not distinguish between the goods and services categories. Is the distinction important? Here, we highlight the different behavior and determinants of goods inflation and services inflation and suggest, based on preliminary analysis, that we can improve the forecast accuracy of this conventional core inflation measure by combining separate inflation forecasts of the two categories.

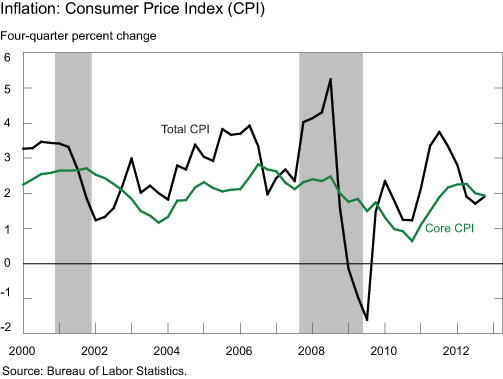

As specified in the Federal Reserve Reform Act of 1977, the Federal Reserve’s mandate is “to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” Given long and variable lags between changes in monetary policy and the subsequent impact on the economy, meeting these goals is greatly facilitated by being able to accurately forecast the behavior of inflation over a one-to-two-year horizon. This, of course, is easier said than done, as headline inflation measures, such as Consumer Price Index (CPI), tend to be quite volatile, due in large part to sharp swings in energy and food prices.Because of the volatility in headline inflation, policymakers have relied on core inflation measures designed to differentiate between transitory and persistent price changes to help guide their decision making. Among the measures of core inflation, the “ex food and energy” series has been the most widely adopted for this purpose (see this paper by Timothy Cogley for a discussion of other core inflation measures). This measure, shown in the chart below, is a much less volatile series that is indicative of lower-frequency changes of the general price level and has also proved to be a more accurate predictor of headline inflation than past headline inflation.

Continues at: Liberty Street Economics