Construction Improves, Yet Is Still Historically Low

click for giant graphic

Graphic courtesy of NYT

Norris:

“Home construction is booming in the United States, but it remains severely depressed.

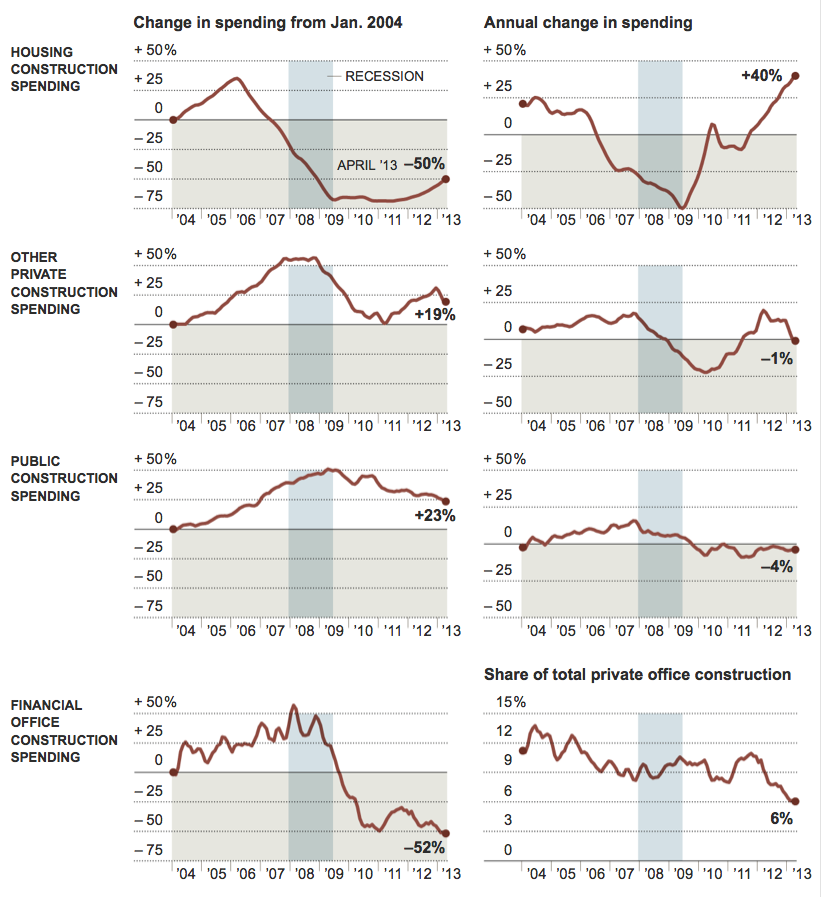

That seemingly contradictory statement was illustrated by construction spending statistics issued this week by the Census Bureau. In April, spending on the construction of new houses and apartment buildings reached an annual rate of $195 billion. As can be seen in the accompanying charts, spending on home building is up 40 percent over the last year.

That is the largest such increase since the early 1980s. In the housing boom that preceded the Great Recession, such spending never rose more than 25 percent over a 12-month period. But that rate of spending is down more than 60 percent from the peak, reached in 2006, and is lower than spending as far back as 1997.”

Why do we keep shooting ourselves in our collective national foot?

Source:

Construction Improves, Yet Is Still Historically Low

FLOYD NORRIS

NYT, June 7, 2013

http://www.nytimes.com/2013/06/08/business/economy/census-reports-home-construction-has-improved.html

What's been said:

Discussions found on the web: