@TBPInvictus

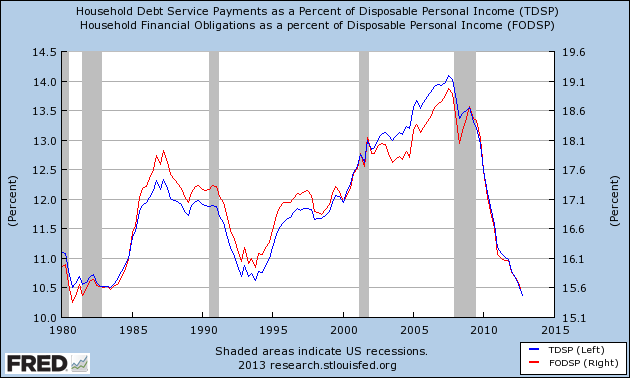

Below I give you two related (and therefore similar) measures of household leverage: Household Debt Service Payments and Household Financial Obligations, each as a Percent of Disposable Personal Income:

Each has hit a record or near-record low for the maximum observable period (regrettably only 33 or so years).

The question must be asked: Is the era of consumer deleveraging, which began just prior to the start of the recession, at an end?

Discuss.

What's been said:

Discussions found on the web: