Yes, that headline is a bit tongue in cheek. I doubt very much that the unrest in Turkey is a driver of equity prices globally.

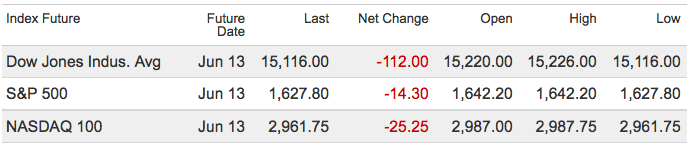

If you are looking for an after-the-fact rationalization as to why stocks are off about 1-2% worldwide, your culprit is more likely the Yen than anything else. It strengthened after Bank of Japan Governor Haruhiko Kuroda failed to discuss more stimulus, leading junkies everywhere to fear that their supply of that good shit was not going to find its way into their veins. No dopamine rush this morning, kids.

Also worth noting: There are less than three weeks left in Q2, and pre-announcement season is upon us. Look for an uptick in negative warnings as the impact of the Sequester is felt.

There are other signs of the ongoing slow recovery. The general economics data is mixed, with no imminent stall seen but no ignition of animal spirits either. (At least, outside of equity markets). Hence, with the focus on risk assets and speculation, the market moves seem to have an outsized mindshare of what’s covered in the media versus their relative size and import — versus what really matters — these days.

Regardless, our context remains a market that has simply run too far too fast not to not be overdue for a pullback. Consider that 16% YTD to the peak in May (38.4% annualized) and 2.3% (w/divs) in with May (~27% annualized) is not what a 2% GDP typically produces (though there is minimal correlation most of the time between economics and equities). These are obviously unsustainable paces, and at the very least require some digestion. The tone of the market has changed, and the straight up silliness is likely put back in its box until next season. Anyone who is surprised by the backing & filling after the past 6 months hasn’t really paying attention.

At this point, most traders (and even many investors) are trying to discern whether this is a mere refractory period or the end of the bull cycle. Its still too early to make either claim decisively. I find it to be helpful to hunt for various signs of confirmation or divergence in market internals, various sectors, and even classic Dow Theory plays out. There is enough meat in those areas that its worthy of its own post, coming some time in the near future.

What's been said:

Discussions found on the web: