Yammy:

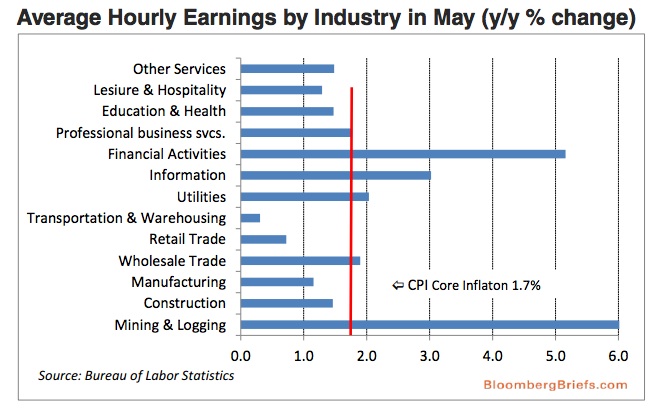

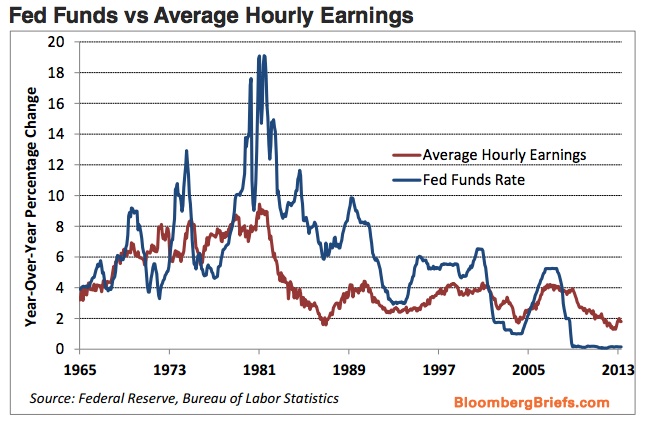

“The greatest issue plaguing the U.S. economic recovery is the dismal pace of real income and wage growth. As long as incomes do not keep up with the underlying rate of inflation, the economy cannot manage enough growth to foster job creation. Average hourly earnings were unchanged in May, and only 2 percent higher than year ago levels. In other words, consumers are simply running in place. This is particularly frustrating for those at the lower end of the income spectrum.

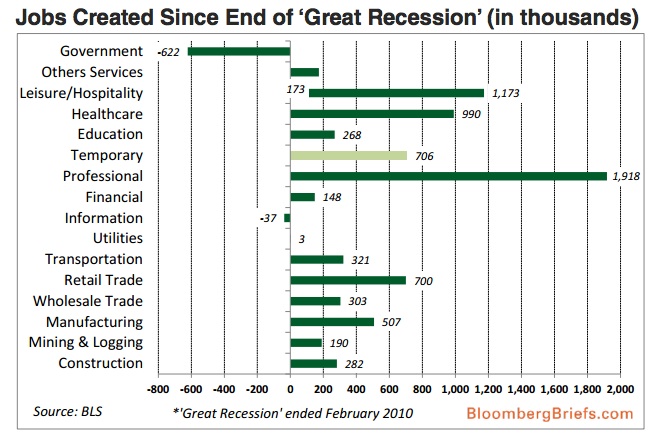

According to the report, 96,300 of the 175,000 new nonfarm jobs created last month were in very low wage industries (retail, 27,000), temporary, (25,600), leisure and hospitality (43,000). The industries with the two lowest hourly wages are leisure and hospitality at $11.76 per hour and retail at $13.92 per hour. Even more concerning is that many of these positions are being filled by older, formerly retired persons who are taking away employment opportunities for young people. The unemployment rate for teenagers (16 to 19 years) increased to 24.5 percent in May from 24.1 percent in April.

This is not a social judgment; it’s economics. That middle income strata — the primary driver of the U.S. economy — has fallen to the low income, and the low income has plunged to poverty. Now it’s just the “haves” in the driving seat, and once the stock market gets hit, it will fall down a rung too.”

Not especially encouraging . . . Its something I would very much like to see improve . . .

Source:

Richard Yamarone

Bloomberg Briefs, June 10, 2013

What's been said:

Discussions found on the web: