Back in August of 2011, Gallup decided to do what they do best — which is poll the American public for their thoughts. In this instance, it was their thoughts on investing.

The questions asked was simply: What do you think is the best long term investment?

Their answers were very instructive: 34% of Americans said gold is the best long-term investment. Real estate came in second at 19% with stocks at 17% in third, and bonds at 10%.

Of course, the public has the tendency to emphasize what just happened, rather than what is likely to happen. We need to keep that in mind when we look at how well the public has done since then.

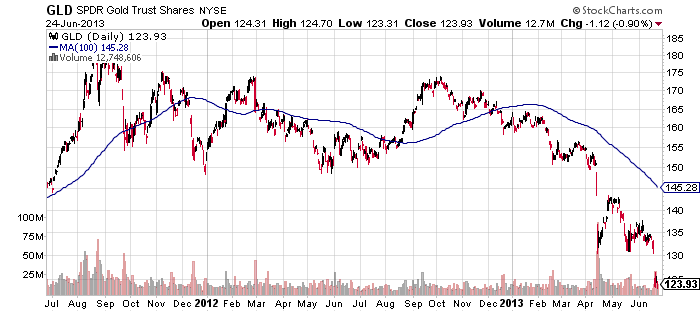

Let’s start with the public’s then favorite investment, Gold: As a reminder, the shiny yellow metal was approaching an all time high of $1900 per ounce, in August 2011, about to embark on a 35% crash, still in progress.

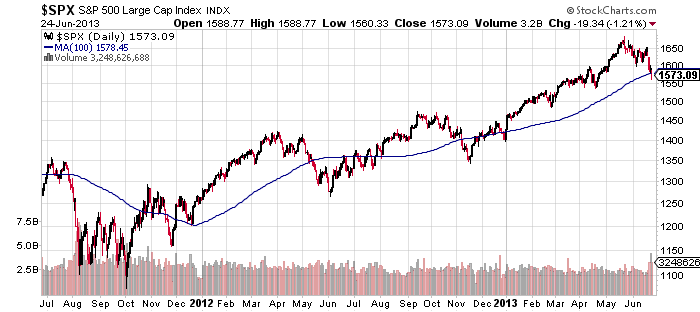

How about Equities? They were the 3rd of the 4 investments — how has the public done with that pick? As the chart below shows, not too well. Back in August 2011, the SPX was around 1100. Its since rallied 50% (including the recent sell off since May).

Note that the S&P500 was not the best performing index — others, notably Russell 2000, have done much better. But since its the benchmark, I chose that chart. Nice call, Public! (not).

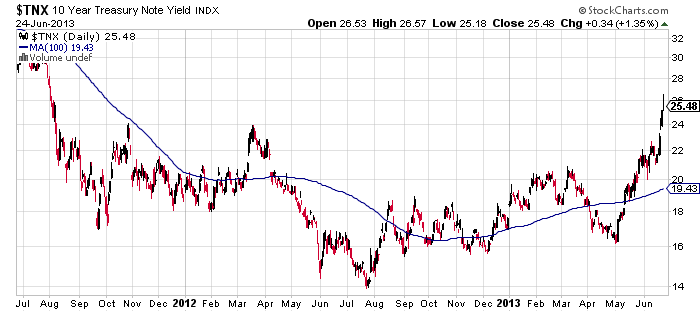

The masses, believe it or not, got their least favorite asset class, Bonds wrong too. Despite the incredible run up in yields this month, bond prices are still above (and yields below) where they were in August 2011.

Treasury Bonds (Yield inverse to price)

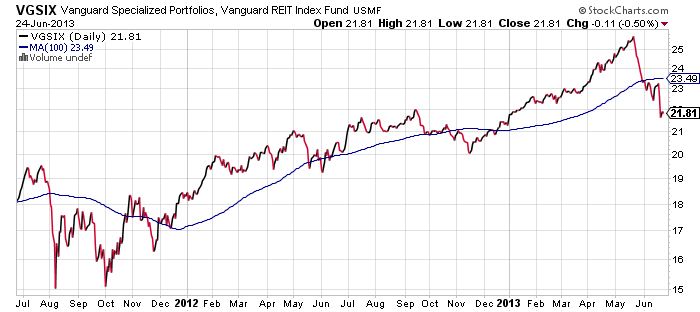

The public did get one things right — Real Estate has been rallying since 2011. It was their second favorite asset class behind gold. The Vanguard REIT index is up about 30% since then — so they did manage to pick one asset class out of 4 that worked out.

The public has spoken! As a reminder, you might want to avoid following their advice . . .

Previously:

Best Investment According to the Public? Gold (May 3rd, 2012)

Source:

Americans Choose Gold as the Best Long-Term Investment

Men, seniors, middle-income Americans, and Republicans are more enamored with gold

by Dennis Jacobe, Chief Economist

http://www.gallup.com/poll/149195/americans-choose-gold-best-long-term-investment.aspx

What's been said:

Discussions found on the web: