Look Out Below, Fed Tapering Edition

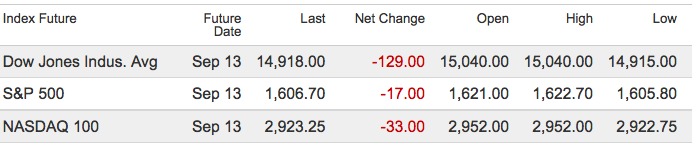

click for updated futures

Really!?!

Really traders!?! Did you really believe that the Fed was never going to stop buying bonds? Really?!?

Do you think that the Fed was going to have an infinite accommodation, and that rates were going to stay at zero forever? Is that what you expected from the Central bank. C’mon, Really!?

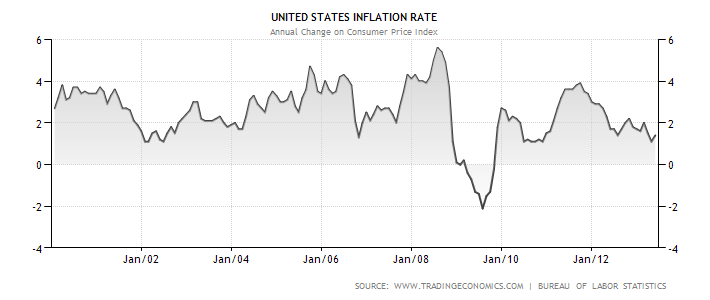

And what about the dreaded hyper-inflation you have been warning us about for so long? Inflation has been so low for so long that it had its name legally changed to Deflation. Really!

Source: Trading Economics

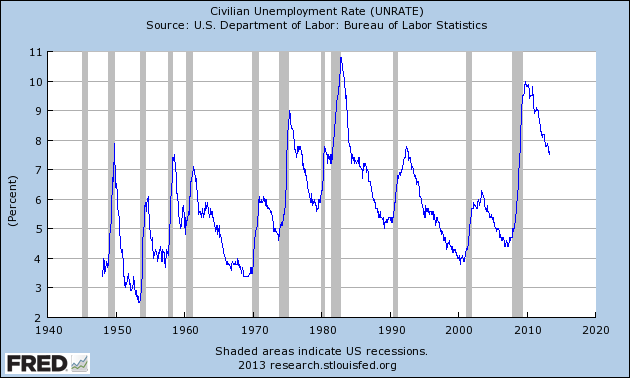

Where you out the day Bernanke said he was targeting Unemployment, which has fallen from nearly 11% to 7.6%? Did you forget about that? Really!?!

Source: FRED

And this entire Risk On rally — did you really think it was going to last forever? Really? US Equity are up nearly 150% over the past 5 years, didn’t you think it had to eventually slow down? Did you actually believe Markets were a uni-directional bet? Really?!?

The Fed has a dual mandate — stable prices and maximum employment. Did you really think there was a third component of maximizing your risk free equity returns? Really!?

~~~

This has been Really!?! With Ben & Janet.

~~~

What's been said:

Discussions found on the web: