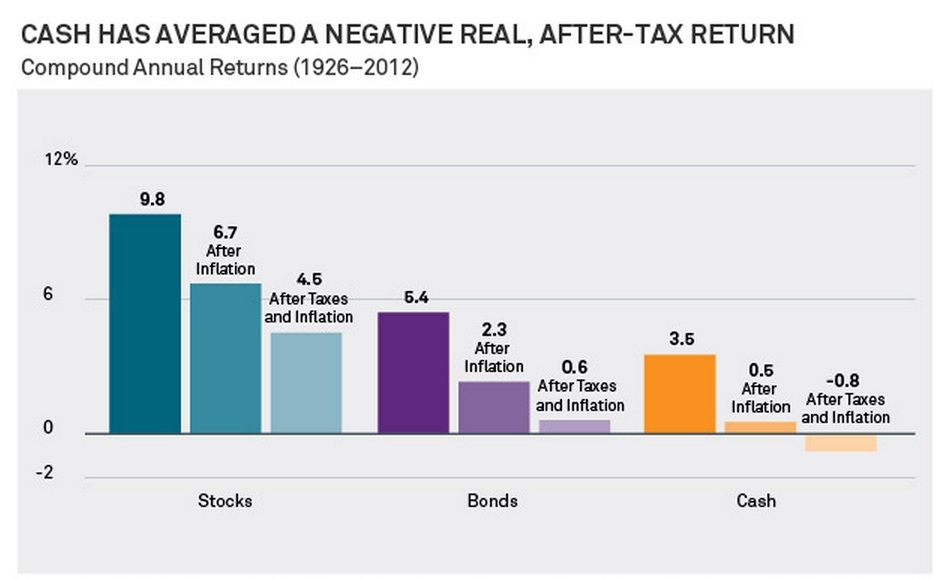

I am not sure I fully agree with this BlackRock chart — there are times when cash makes sense. However, I cannot disagree with the takeaway that you cannot sit in cash for very long stretches of time (years) and expect any sort of return above inflation.

Click to enlarge

Source: BlackRock

What's been said:

Discussions found on the web: