Source: Motley Fool

Morgan Housel has a very insightful column this morning, driven by one of my favorite topics: Taking yourself out of the minute-to-minute, day-to-day time frame and rethinking your investing parameters in terms of years and decades.

That longer time frame is an enormous luxury, a monstrous advantage amateurs at home have over the pros.

Here’s Housel:

“You’re trying to fund your retirement over the next 20 years. Hedge fund managers have to woo their clients every month. You’re saving for your kids’ education next decade. Mutual fund managers have to fret about the next quarter. You can look years down the road. Traders have to worry about the next ten milliseconds.

Most professional investors can’t focus on the long run even if they want to.”

Or to be even more succinct, Henry Blodget observes that professional managers are “thinking about the next week, possibly the next month or quarter. There isn’t a time horizon; it’s how are you doing now, relative to your competitors. You really only have ninety days to be right, and if you’re wrong within ninety days, your clients begin to fire you.”

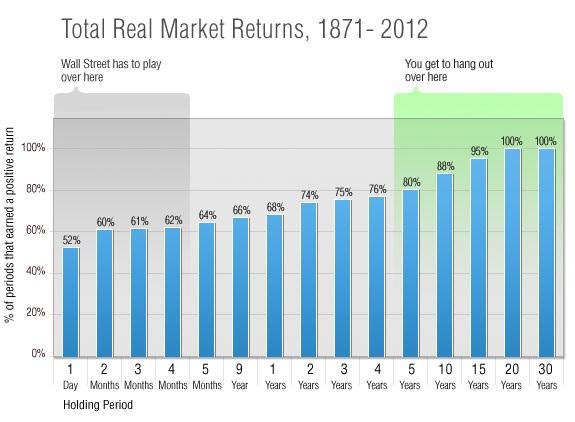

That is the beauty of the chart above showing (inflation-adjusted) S&P500 returns going back to 1871 relative to various holding periods.

Short term is more or less random; longer term, the odds move in your favor. And very long term approaches 100% positive returns, even after inflation.

“Hold stocks for a year (Wall Street’s territory) and you’re at the mercy of the market’s madness — maybe a huge up year, or maybe a devastating loss. Five years, and you’re doing better. Ten years, and there’s a good chance you’ll be sitting on positive annual returns. Hold them for 20, 30, or 50 years, and there has never been a period in history when stocks produced an average annual loss. In fact, the worst you’ve done over any 30-year period in history is increased your money two-and-a-half fold after inflation. Wall Street would love to think about those numbers. Alas, it’s busy chasing its monthly benchmarks.”

Go read the full piece + see the rest of the charts. Its great stuff . . .

Source:

Your Last Remaining Edge on Wall Street

Morgan Housel

Motley Fool, June 18, 2013

http://www.fool.com/investing/general/2013/06/18/your-last-remaining-edge-on-wall-street.aspx

The Rolling Stones – Time Is On My Side

What's been said:

Discussions found on the web: