My afternoon train reads:

• Finally, a half decent explanation of the Hindenburg Omen (ETF Daily News)

• ‘Financialization’ as a Cause of Economic Malaise (Economix)

• Crazy Eddie fraudster says SEC can’t keep up (MarketWatch)

• For Sussing Out Whether Debt Affects Future Growth, the Key is Carefully Taking into Account Past Growth (Supply Side Liberal)

• Apple’s Good Looks Get It Only So Far (WSJ) see also From Apple, an Overhaul for Mobile and the Mac (NYT)

• The Amish Are Getting Fracked: Their Religion Prohibits Lawsuits—and the Energy Companies Know It (New Republic)

• There is No Such Thing as Invention (IMHO)

• 5 Maps That Show How Divided America Really Is (Atlantic Cities)

• The Awful Truth About Jogging (robicellis)

• Stat humor! Study says 83% Of Gamblers Quit Right Before They Would Have Hit The Big One (Onion)

What are you reading?

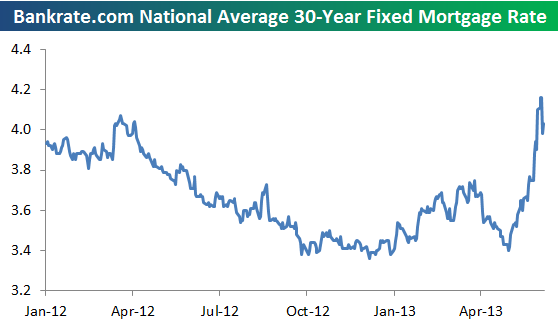

Spike in Mortgage Rates

Source: Bespoke

What's been said:

Discussions found on the web: