My afternoon train reads:

• The Zero Upper Bound? (Noahpinion)

• How I Learned To Build Products People Care About (Fast Company)

• 850K Underwater Mortgages Finally Gasp for Air in 1Q (Fox)

• The Unlikely Evolution Of The @ Symbol (Fast Company)

• Silicon Valley’s Long History of Government Codependence (Echoes)

• CIA Chooses: Amazon or IBM? (WSJ)

• Connecting the Dots on PRISM, Phone Surveillance, and the NSA’s Massive Spy Center (Wired)

• Using Metadata to Find Paul Revere (Kieran Healy) see also Paul Revere’s Vision of Occupied Boston (The Vault)

• Voice-Activated Technology Is Called Safety Risk for Drivers (NYT)

• Amazon Will Seize 3D Printing (Climateer Investing)

What are you reading?

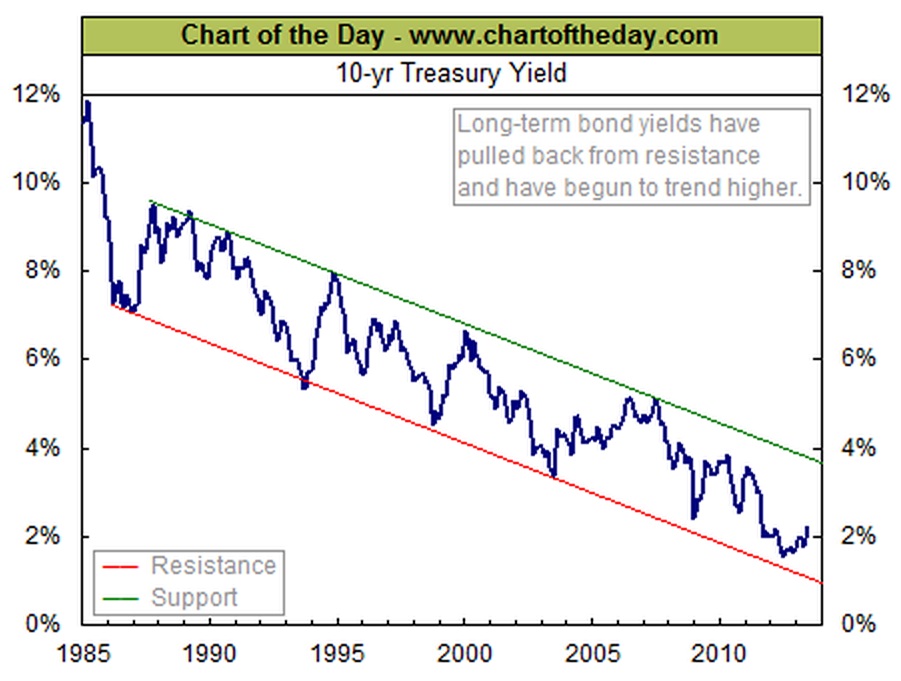

27-year trend of the 10-year Treasury bond

Source: Chart of the Day

What's been said:

Discussions found on the web: