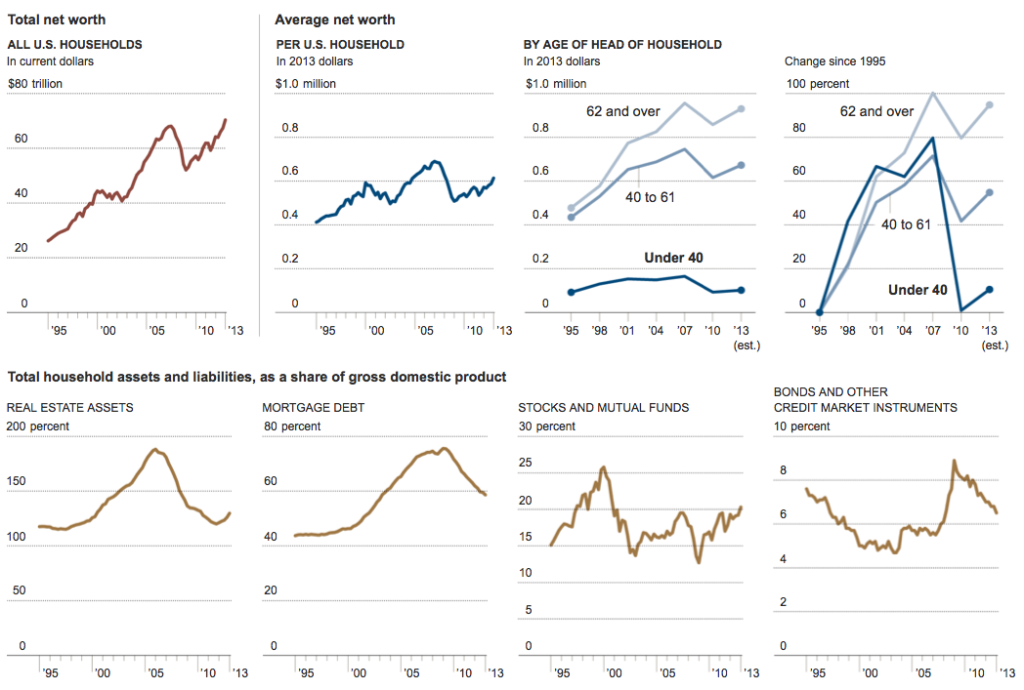

The Old Get Richer, but Not the Young

click for bigger chart

Courtesy NYT

I have some good news and some bad news:

The good news is that the total wealth of US households are slowly recovering from the credit crisis and Great Recession.

The bad news is it has not been sufficient to keep up with inflation; lots of people — especially those who loaded up on debt before the collapse — are lagging.

Household wealth rose by $3 trillion in Q1, to $70.3 trillion — greater than the $68.1 trillion in Q3 2007, before the recession began. About a third of the gains were courtesy of rising stock prices, another third was rising real estate values.

All is not rosy, as Floyd Norris reminds us:

“The Federal Reserve Bank of St. Louis pointed out that there are more households now than there were in 2007, and that there has been inflation as well. As can be seen in an accompanying chart, the average household wealth at the end of the quarter was $613,635, a figure that is 11 percent below the peak of $689,996 (in 2013 dollars) set in the first quarter of 2007.

Those averages are deceptive, in that they are raised by the high wealth of a relatively small number of households. A very different picture emerges from looking at the median — the level at which half the households are richer and half poorer. That statistic can be calculated from the Fed’s triennial survey of consumer finances. In the studies conducted in the 1990s, the median net wealth was about one-quarter of the average. In the 2000s, the median fell to about one-fifth of the average, and in 2010, it was down to about one-sixth of the average.”

The bifurcated economy continues to get ever more stratified . . .

Source:

Younger Households Are Slower to Make Gains in Net Worth

Floyd Norris

NYT June 14, 2013

http://www.nytimes.com/2013/06/15/business/economy/despite-recovery-younger-households-are-slower-to-make-gains.html

What's been said:

Discussions found on the web: