Wow, thats a helluva number for NFP this morning. If you don’t have anything better to do, here are some non NFP related reads to keep you otherwise occupied while the rest of us slip away . . .

• Fedspeak: Complex Monetary Policy Spawns Flights of Metaphors (WSJ)

• Surprise! Inflation is too low almost everywhere on earth (Wonkblog)

• Krugman: 2/3rds of Americans live in metro areas with half-a-million or more residents (NYT)

• Do budget deficits cause inflation? (Mainly Macro) see also Sticky Prices vs. Sticky Wages: A Debate Between Miles Kimball and Matthew Rognlie (Supply-Side Liberal)

• In Connecticut, a struggle to launch Obamacare (WaPo)

• Basel Examines Banks’ Diverging Views of Risk-Weighted Assets (Bloomberg)

• Thoughts on the future of finance blogging (FT Alphaville) see also Finance blogging is not for the faint of heart (Abnormal Returns)

• How to Have a Year that Matters (Harvard Business Review)

• Around the world in 20 gaffes (Telegraph)

• The New Barbecue (WSJ)

Whats up for the weekend?

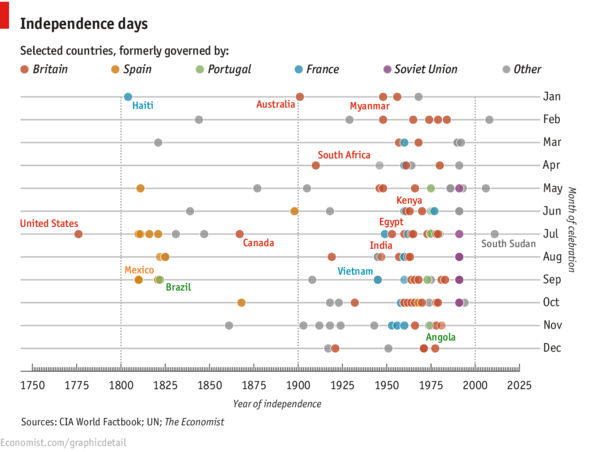

When Countries Celebrate their Independence

Source: Economist

What's been said:

Discussions found on the web: