My morning reads:

• The odds of who will be Next Chairperson of the US Federal Reserve (Paddy Power) see also Jon Hilsenrath Is Not Who You Think He Is (Business Insider)

• Bond Investors Can Run, but They Can’t Hide (Moneybeat)

• The rich blow their money on hedge funds, instead of lottery tickets (The Atlantic) see also Hedge Funds Are for Suckers (Businessweek)

• In Defense of Concentrated Portfolios (Aleph Blog)

• Why John Maynard Keynes Supported the New Deal (Echoes)

• Bruising Quarter for Bond Fund Managers (WSJ) but see Stocks Embark on a Summer of Love (WSJ)

• SEC Lifts Ban on Hedge Fund Advertising. Hilarity Ensues (Businessweek)

• How to Profit from the Shiller Cape Ratio (A Dash of Insight) see also Big Names, Big Market Calls (A Dash of Insight)

• The Dropbox Opportunity (Stratechery)

What are you reading?

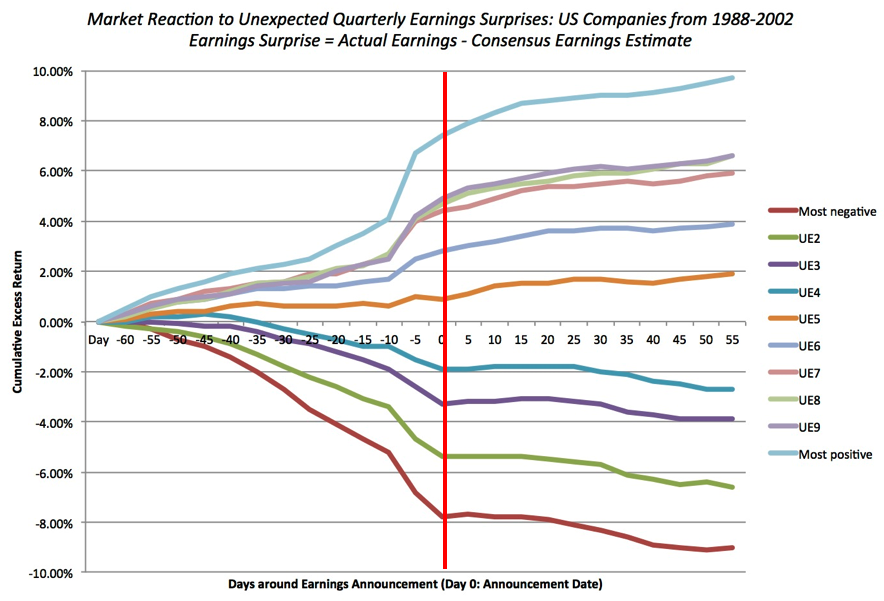

Price discounts the news

Source: Charts etc.

What's been said:

Discussions found on the web: