My 10 morning back-in-NY reads:

• What’s Powering the Strongest Bull Market Since WWII? (Fiscal Times)

• Here’s proof: Uncertainty didn’t hold back economy (MarketWatch)

• Kotok To Whitney: What Planet Are You On? (Index Universe)

• The Correlation Conundrum (Capital Spectator)

• Negative Fed Feedback Loops? (Tim Duy’s Fed Watch)

• More Gold buggery: No, the Comex is not going to default (FT Alphaville)

• Silicon Valley is Hacking Your Food (Inc.)

• Why Larry Summers Won’t Be Fed Chair (Barron’s) see also Larry Summers and the Pivot to Austerity (Calculated Risk)

• What if Mitt Romney had won? (Economist)

• MIT creates the first perfect mirror (Extreme Tech)

What are you reading?

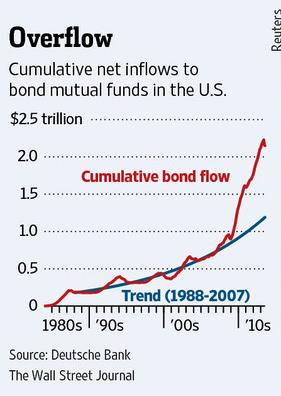

Bonds Could Get Swept Away by the Flow

Source: WSJ

What's been said:

Discussions found on the web: