My morning reads:

• The Tale of Apple Average Selling Price (Marketing Strategy and Pricing) see also Is Apple Really Going to Join a Race to the Bottom? (Businessweek)

• Keep Investing as Simple as Possible (Motley Fool)

• Strongest Bull Market In 65 Years (The Reformed Broker) see also Historic market rise underway (msnmoney)

• The Death of Peak Oil: End of a Flawed Theory (Fiscal Times)

• Has value investing worked in Japan’s long bear market (1990 to 2011)? (Greenbackd)

• Sorry, commodities are a poor diversification tool (FT Alphaville) see also Do Commodities Speculators Make Things Cost More? (Harvard Business Review)

• Why slower U.S. home sales signal a good recovery (Fortune)

• The Burmuda Triangle of Punditry (PunditTracker)

• Easing of Mortgage Curb Weighed (WSJ)

• Apparently Undergraduate Finance Students Believe in ESP (MoJo)

What are you reading?

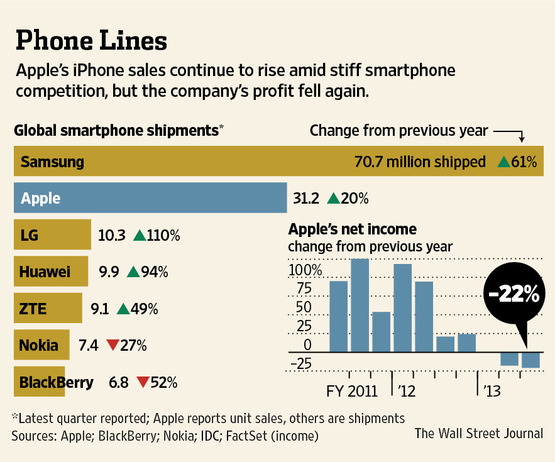

Apple Sales: Profits or Volume

Source: WSJ

What's been said:

Discussions found on the web: