My afternoon train reads:

• Eisinger: Heartening Moves Toward Real Progress in Bank Regulation (DealBook) see also Elizabeth Warren Tackles Wall Street (Nation)

• How Far Should Fed Go to Pop Potential Bubbles? (Real Time Economics)

• What Has Happened to PIMCO All Asset All Authority? (And should you stick with it?) (Institutional Imperative)

• Is Germany Repeating American Errors at Bretton Woods? (Echoes)

• The ultimate buy-and-hold strategy (MarketWatch) but see Critical Warning No. 17: Dow 5,000, crash of 65% (MarketWatch)

• Unexpected Drop in Starts Curbs U.S. Housing Rebound (Bloomberg)

• Germany’s Gold Delusion (Project Syndicate) see also Golden Slumbers (Project Syndicate)

• While Washington Sleeps, a Nation Crumbles (HuffPo)

• With warming seas, lobsters become an abundant bargain (Boston Globe)

• 10 mindblowingly futuristic technologies that will appear by the 2030s (io9)

What are you reading?

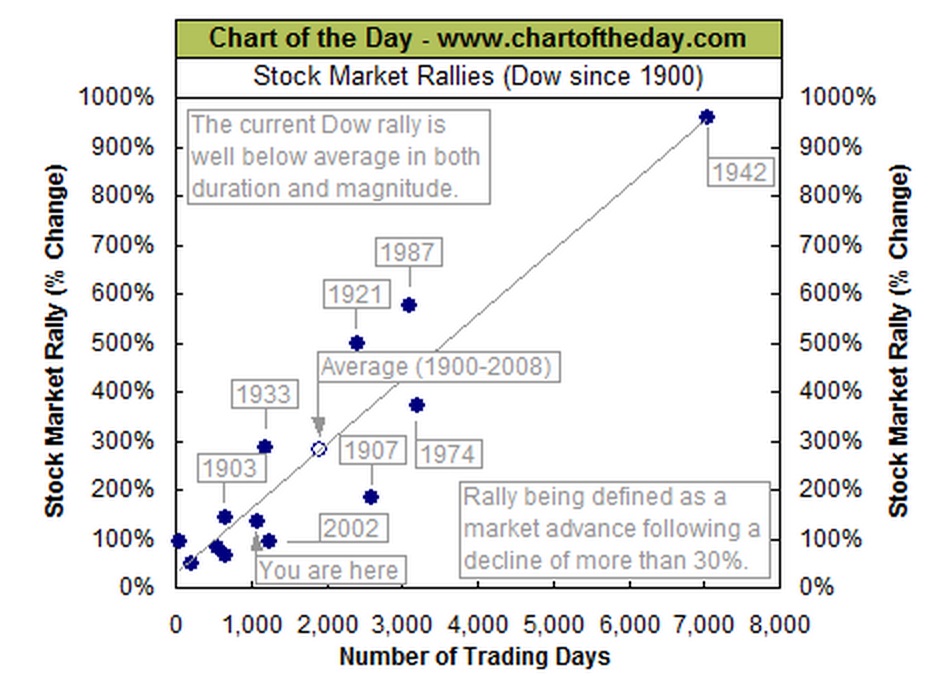

Stock Market Rallies

Source: Chart of the Day

What's been said:

Discussions found on the web: