My pre Fourth of July reads (hey, the weather stinks today, so I have to do something productive!)

• CNBC Quarterly Ratings Fall To Lowest Level Since 1994 (ValueWalk)

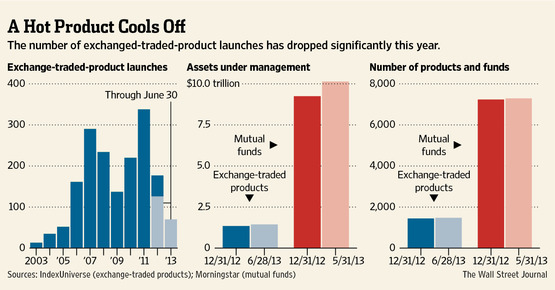

• The Hunt for the Never-Been-Done ETF (WSJ) but see Coming Soon: TBTF ETF (TBP)

• Gartner: Tech Spending Will Reach $3.7 Trillion in 2013 (All Things D)

• A reasonable look at 5 (really 4, 1 is repeated) things that could derail US equities this summer (USA Today)

• The Rise Of Real Yields (The Capital Spectator)

• Jose de la Vega’s Investing Rules (Crossing Wall Street) see also Portfolio Managers Face Their Kobayashi Maru (The Reformed Broker)

• ‘World’s largest building’ opens in China (CNN)

• Federal Reserve wont wait for Congress dithering, orders Basel set aside capital rules implemented (Washington Post) see also Banks benefiting from “taper” on both sides of the balance sheet (Sober Look)

• Remedies for Better Cellphone Signal and Quality (NYT)

• Why Americans Are Eating Fewer Hot Dogs (Businessweek) see also What yellow commodity is hotter than gold? (MarketWatch)

Where are you off to this long weekend?

The Hunt for the Never-Been-Done ETF

Source: WSJ

What's been said:

Discussions found on the web: