My morning reads:

• ‘Fabulous Fab’ Trial: How to Create a Synthetic CDO (Moneybeat)

• Forget Battery Swapping: Tesla Aims to Charge Electric Cars in Five Minutes (MIT Technology Review) see also Peek Inside Tesla’s Robotic Factory (Wired)

• Kazarian Emerges After 20 Years With Bid for 10% of Greek Debt (Bloomberg)

• Today’s WTF headline: IKEA becomes largest foreign landowner in China (Want China Times)

• John Galt and the Theory of the Firm (The Conscience of a Liberal) see also At Sears, Eddie Lampert’s Warring Divisions Model Adds to the Troubles (Businessweek)

• The Return of Lawrence Summers, Mr. Spectacular Failure (Nation)

• For hire: Professional liars for job seekers (CNNMoney)

• Why Do Mosquitoes Bite Some People More Than Others? (Smithsonian)

• Jenny McCarthy’s Dangerous Views on Vaccination (Elements) see also Anti-Vaccine Body Count (Jenny McCarthy Body Count)

• Skyscraper Builders Reach for the Stars Once Again (WSJ)

What are you reading?

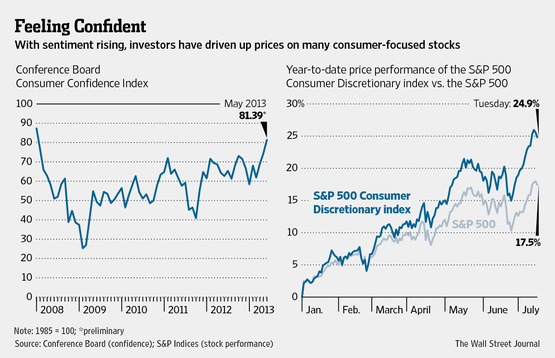

As Consumer-Discretionary Stocks Surge, Bears Lurk

Source: WSJ

What's been said:

Discussions found on the web: