My morning reads:

• This is the best thing you will read today: Saving Investors From Themselves (Moneybeat)

• Who Goes to Cash Shows Extent Bonds Will Become Bear Market (Bloomberg)

• Using Money to Buy Happiness (Scientific American)

• Money as Credit (Mainly Macro) see also Gold Swings With Silver After Drop to Lowest Since 2010 (Bloomberg)

• Japan’s New Growth Strategy: Bringing Rapid Reform To the Country (LinkedIn)

• New threats to China’s property bubble (Sober Look) see also China’s ghost cities epitomize the problem with printing money Paul Krugman-style (Quartz)

• When Italians Chat, Hands and Fingers Do the Talking (NYT)

• Baseball’s Battle for Silicon Valley (WSJ)

• The Physics Behind Traffic Jams (Smart Motorist)

• Daft Punk’s ‘Get Lucky’: How to Build the Song of the Summer (Businessweek)

What are you reading?

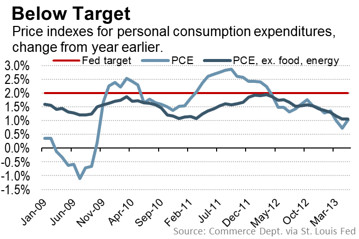

Low Inflation Highlights Fed Dilemma

Source: WSJ

What's been said:

Discussions found on the web: