My morning reads:

• Praying for an Immaculate Rotation from Bonds to Stocks (Barron’s) see also Short Looks Beautiful to Bond Investors (WSJ)

• What Bear Market? Japan Stocks Are Surging Again After Big Fall (Moneybeat)

• Why We Underestimate Risk by Omitting Time as a Factor (Bloomberg) see also Correlation and Causation (Seeking Wisdom)

• The need for less speed (Tim Harford)

• Rock Legends Guides to Eurocrisis (ECR Research)

• A Portfolio That’s as Simple as One, Two, Three (WSJ)

• Do the inflationistas really believe what they say? (Noahpinion)

• The Best $500 Billion the United States Has Ever Spent (Motley Fool/NBC) see also Will Clinton Be Our Eisenhower? (Economic Principals)

• I Don’t Care Whether You Trust me; I Won’t Add You to my LinkedIn Network (LinkedIn)

• Yes, Kickstarter raises more money for artists than the NEA. Here’s why that’s not really surprising (Wonkblog)

What are you reading?

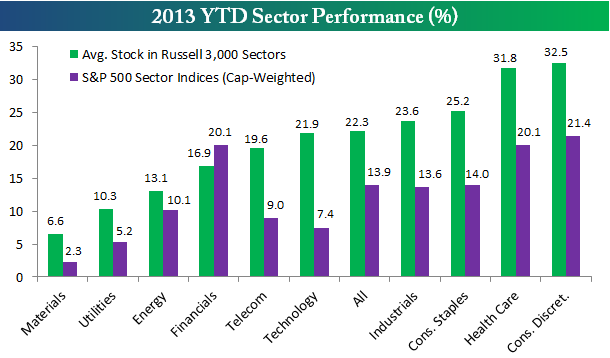

2013’s Top Stocks…So Far

Source: Bespoke

What's been said:

Discussions found on the web: