My afternoon train reading:

• The computers that run the stock market (CNNMoney)

• A Portfolio That’s as Simple as One, Two, Three (WSJ)

• Consumers Boost Borrowing (Real Time Economics) see also It’s Not Just ‘Jobs,’ It’s the Kind of Jobs That Matters (Moneybeat)

• S&P to court: Reasonable investors wouldn’t rely on our ‘puffery’ (MarketWatch)

• Audi to Zappa See Trade Talks as Chance to Cut Rules (Bloomberg)

• Good Urban Design Losing in Miami Beach (World Property Channel)

• How Spitzer as comptroller could impact Wall Street (MarketWatch) see also Sex Scandal, Just Another Spitzer Campaign Event (Bloomberg)

• China’s Great Rebalancing Act (The Diplomat)

• Top iOS apps and games go free ahead of App Store’s fifth anniversary (Verge) see also The Only Smartphones Worth Buying Right Now (Business Insider)

• Scientists find black hole bonanza (CNN)

What are you reading?

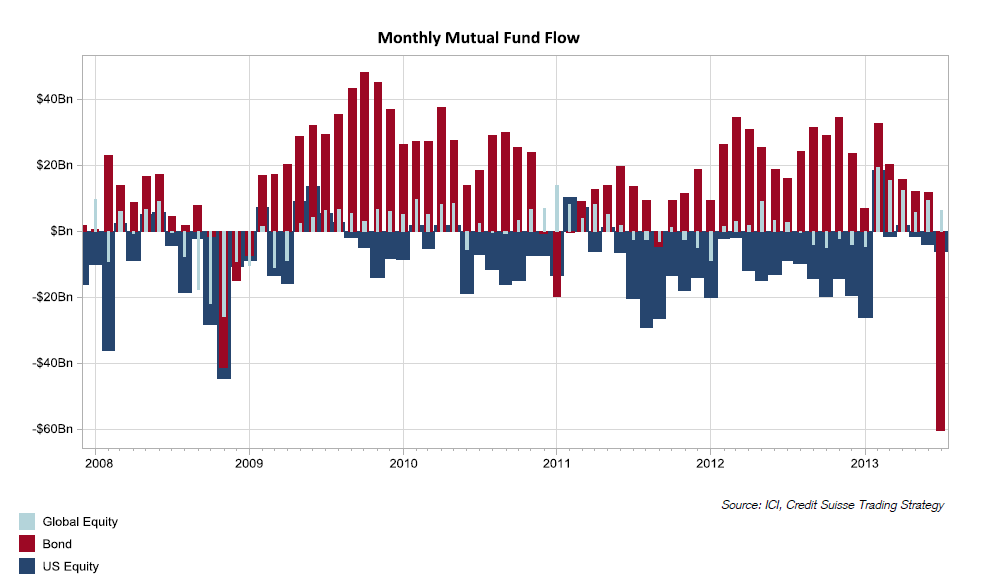

The bond fund outflow, charted

Source: FT Alphaville

What's been said:

Discussions found on the web: