My afternoon train reading:

• Why the Fed Wants Higher Prices (Barron’s)

• Hedge Funds Bought Gold in Biggest Rally Since 2011 (Bloomberg) but see Gold is a popping bubble, too (Marketwatch)

• What Should We Expect For Long Run Risk Premiums? (Capital Spectator)

• China’s GDP and the investment factor (FT Alphaville)

• Private-Equity Buyouts Shortchange Shareholders (MoneyBeat)

• Cohan: Free Fab! Then Go After Fuld and Cayne and O’Neal. (Bloomberg)

• What does it even mean to “believe” something? (Noahpinion) see also Information wants to be expensive (Reuters)

• Why ‘Made in the U.S.A.’ is still a viable model for some local manufacturers (Washington Post)

• Seeing Apple in Microsoft’s reorganization (Fortune)

• Fine Print: master inventory of canned responses for online dispute resolution. (@pourmecoffee)

What are you reading?

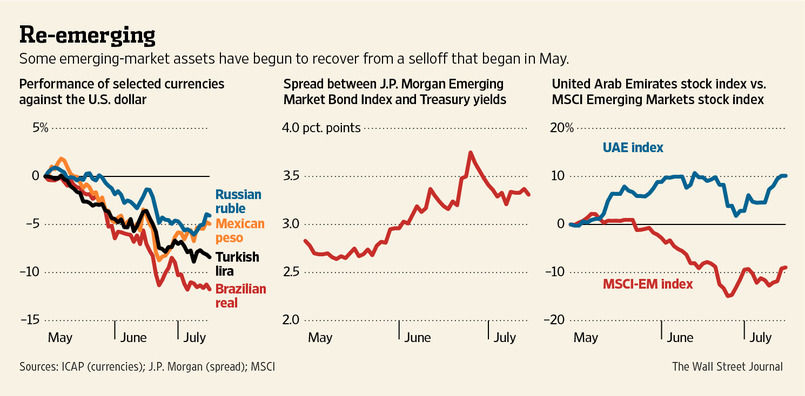

Emerging-Market Rout Offers Bargains

Source: WSJ

What's been said:

Discussions found on the web: