My early Sunday morn reads:

• Fund Managers Should Go Into the Closet When Markets Drop (Investment News)

• Zweig: Understand the difference between ‘Shallow Risk’ and ‘Deep Risk’ (Moneybeat)

• Corporate Investment: A Mysterious Divergence (FT.com)

• Toyota Outsold by GM Signals Long-Term Japan Demand Slump (Bloomberg)

• CNBC Fed poll: 50% say Obama should pick Yellen; 2.5% say he should pick Summers (WaPo) see also Summers a Bane for Treasury Bonds; Yellen a Boon? (Moneybeat)

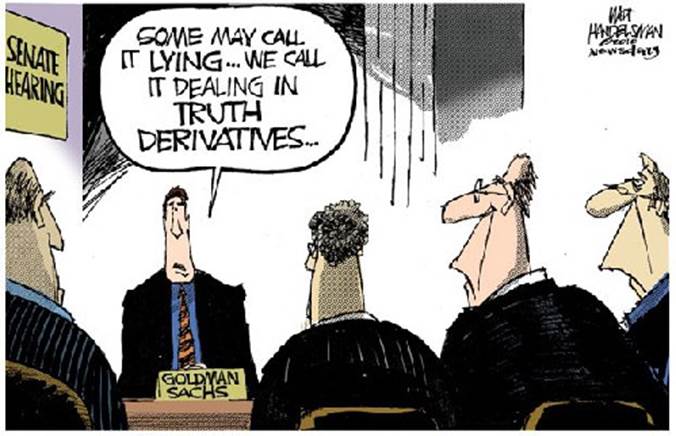

• Denninger: Glass-Steagall: Where Are The Tea Partiers And Republicans? (Market Ticker)

• Your Smile Can Change the World. All You Have To Do is Grin and Bare It… (theguardian)

• The Zombie Argument that Refuses to Die: Shakespeare: William Shakespeare (Standpoint Magazine)

• How America’s Top Tech Companies Created the Surveillance State (National Journal)

• Hollywood’s Reliance on Sequels Makes for a Pallid Picture (WSJ)

Whats for brunch today?

What's been said:

Discussions found on the web: