Hope the weather has been good in your part of the world.

While you await your significant other to get ready to head out this evening, here are some reads to keep you busy:

• The Fed’s magic jobs number (Fortune)

• Gold – Has the ‘Narrative’ Failed? (Acting Man)

• Elizabeth Warren Tackles Wall Street (The Nation)

• Release of Pent-up 2Q 2013 Manhattan Sales Report (Miller Samuel Inc.)

• Why doesn’t Apple enable sustainable businesses on the app store? (Stratechery)

• The Answer is a Click Away: The Internet Era’s Great Placebo Effect (Medium) see also 4 Steps to Viral, Or How to Create Infographics That Blow up the Web (visual.ly)

• Pandora Paid Over $1,300 for 1 Million Plays, Not $16.89 (The Understatement) see also Pandora and Royalties (Pandora)

• The Immortal Life of the Enron E-mails (MIT Technology Review)

• Top Romney adviser calls for third party (Matt Miller) but see The Crazy Republican War on Food Stamps (Atlantic)

• Mariano Rivera: A Singular Pitcher (NYT)

Where are the good fireworks show tonight?

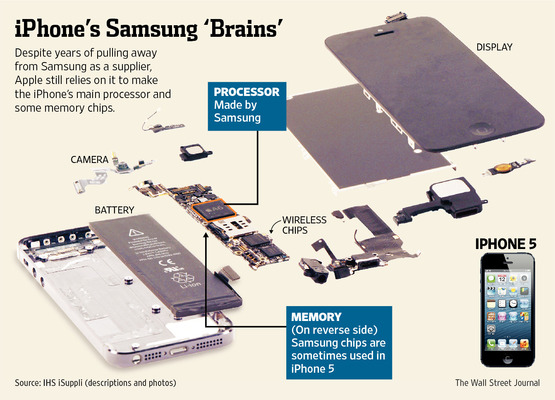

How Much Samsung is in Apple’s iPhones?

Source: WSJ

What's been said:

Discussions found on the web: