My afternoon train reads:

• Chase, Once Considered “The Good Bank,” Is About to Pay Another Massive Settlement (Taibblog)

• Does Fed “Tapering” Represent Fed Tightening? (Econtrarian)

• Close to Retiring? Uh-Oh, So is Your Financial Adviser (Time)

• A Dozen Things I’ve Learned About Investing from Daniel Kahneman (25iq)

• Larry Summers’s Billion-Dollar Bad Bet at Harvard (Ticker)

• Shiller: Bubbles Forever (Project-Syndicate)

• Setting the Baseline for a Better Housing Affordability Index (Political Calculations)

• Facebook’s Surprising Dependency on Premium Content Creators (Digital Quarters)

• 13 Sites For Creative Inspiration (dustn.tv)

• Why Do We All Think We’re Above Average? (priceonomics)

What are you reading?

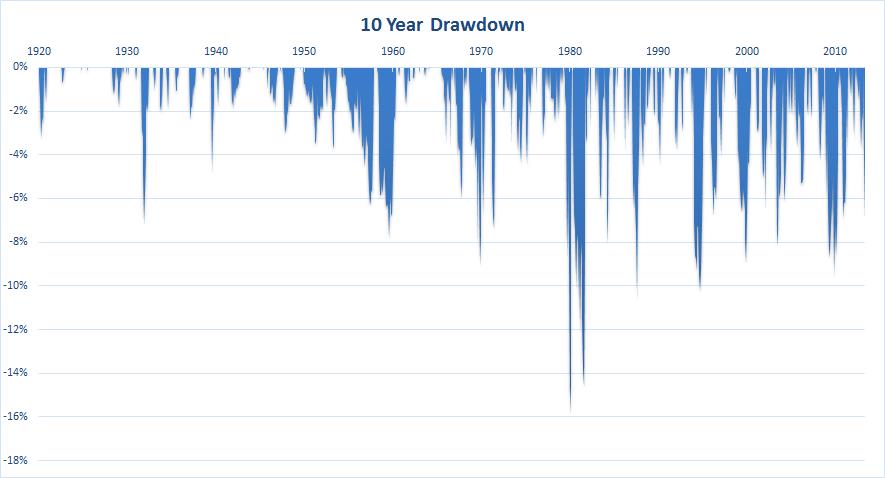

Have Bonds Bottomed?

Source: Mebane Faber

What's been said:

Discussions found on the web: