My morning reads:

• Interest rates 101: Why the party is over (Fortune)

• Corporate Tax Rates Plummet As Profits Soar (National Memo)

• Forward guidance, the ECB way (FT Alphaville) see also After Bernanke, make unconventional policy the norm (FT.com)

• Japan and the liquidity trap (Noahpinion)

• Hedge Fund Alpha is Negative; Down Around 1700 BPs in 11 Years (ValueWalk)

• India may have picked a fight with the markets it can’t win (Quartz)

• The Sequester Is a Failure—Posner (Becker-Posner Blog) but see Market rally puts stock prices in question (USA Today)

• Spitzer: The Steamroller Returns (New York Magazine)

• A Sneak Peek of the National Grid on Renewables (MIT Technology Review)

• The Single Most Important Change You Can Make In Your Working Habits (Farnam Street)

What are you reading?

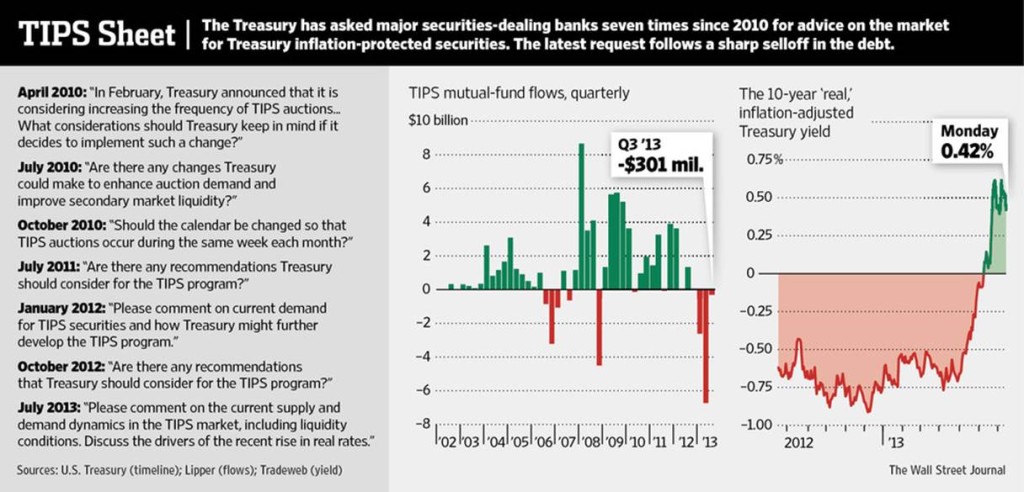

For Treasury, a Question of Fundamentals

Source: WSJ

What's been said:

Discussions found on the web: