My by-the-time-you-read-this,-I’ll-be-in-the-Hamptons afternoon reads:

• Important discussion on how shareholders are getting robbed: Owner Earnings (Seeking Wisdom)

• How Money Actually Buys Happiness (HBR)

• Golden Troubles (Joe Tax Payer) see also Bear market in gold pummels Einhorn’s Greenlight fund (Reuters)

• Why Doesn’t Apple Enable Sustainable Businesses on the App Store (Stratechery)

• Full Employment: The Big Missing Piece (Economix) see also Is There Hope for Recent College Grads? (WSJ)

• What’s Wrong with Technological Fixes? (Boston Review)

• As Bond Market Tumbles, Pimco Seeks to Reassure Investors (DealBook) see also Coercive Monetization (Gamasutra)

• Acts of Journalism and the Espionage Act (boing boing) see also Secret-court judges upset at portrayal of ‘collaboration’ with government (Washington Post)

• Dark Money Group Spent on House Race, Then Told IRS It Didn’t (ProPublica)

• Lou Reed Loves Kanye West’s Yeezus (Talkhouse)

What are you reading?

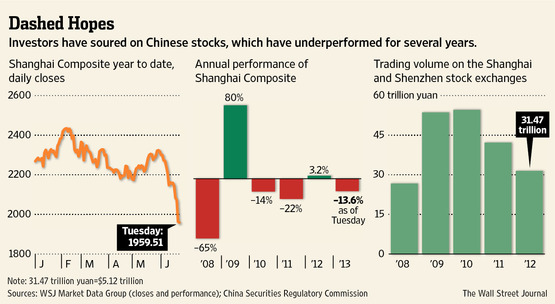

Weak Links Mar Investing in China

Source: WSJ

What's been said:

Discussions found on the web: