My afternoon Canadian reading material:

• Three Big Money Mistakes You Could Be Making Right Now (WSJ)

• What Would You Do To Improve Business TV? (Points and Figures) see also CNBC’s ‘Money Honey’ explores her options (New York Post)

• An interview with… Jason Zweig on Personal Finance (Five Books)

• There Is No Liquidity Trap: Understanding 21st Century Monetary Policy (Peterson Institute for International Economics)

• Bad Real-Estate Deals Return to Haunt Detroit’s Pensions (Bloomberg) see also Is your town going to be the next big bankruptcy? (MarketWatch)

• How much has austerity cost (so far)? (Mainly Macro)

• Happy Birthday to Dodd-Frank, a Law That Isn’t Working (HuffPo) see also Glass-Steagall Is Necessary, but the Argument for It Isn’t (Moneybeat)

• Robin Thicke, a Romantic, Has a Naughty Hit (NYT)

• The pleasure of finding things out (Seeking Wisdom) see also How to Find Your Passion in Life (Fox)

• Must-see clip: Louis C.K. on his “seedy” role in “Blue Jasmine” (Salon)

What are you reading?

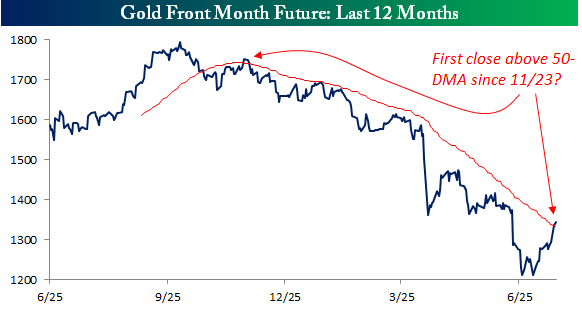

Gold Back Above 50-Day Moving Average

Source: Bespoke

What's been said:

Discussions found on the web: