Will the Fed taper? Are they going to stand pat? Who will replace Bernanke? Is the market going to correct? Is the Fabulous Fab going to lose his litigation? When will the dollar collapse? What about Obamacare? How are earnings going to do this quarter? What about Gold? Are yields going to keep going higher? Will GDP print 1%? How can I make a currency bet? What will rising volatility do? Will we have a recession? How can I have higher returns but less risk? Which Hedge fund manager is the most awesome?

Over the past month, I have seen, heard and read all of the above. They generate a lot of angst amongst investors. I do not believe any possible (honest) answer to these will bring any sort of security or comfort level to investors. Not because I expect these to play out in some terrible way — I don’t really have any foresight into how these play out.

Rather, because these are the wrong questions.

They relate to issues that are completely outside of your control. They offer a distribution of outcomes that provide nothing in terms of your longer investing timeline. You cannot trade around these, at best you can make binary bets on skimpy information along with the rest of the hot money crowd.

Personally, I don’t like those odds: Guessing as to how something will turn out and putting dollars on the line does not ooze with the sort of intelligent planning that leads to long-term, happy outcomes.

What then are the right questions to ask?

What might happen?

How can I benefit when these future events occur?

What is my plan of action if these things do happen?

How can I prepare myself to deal with the inevitable emotional response to these events?

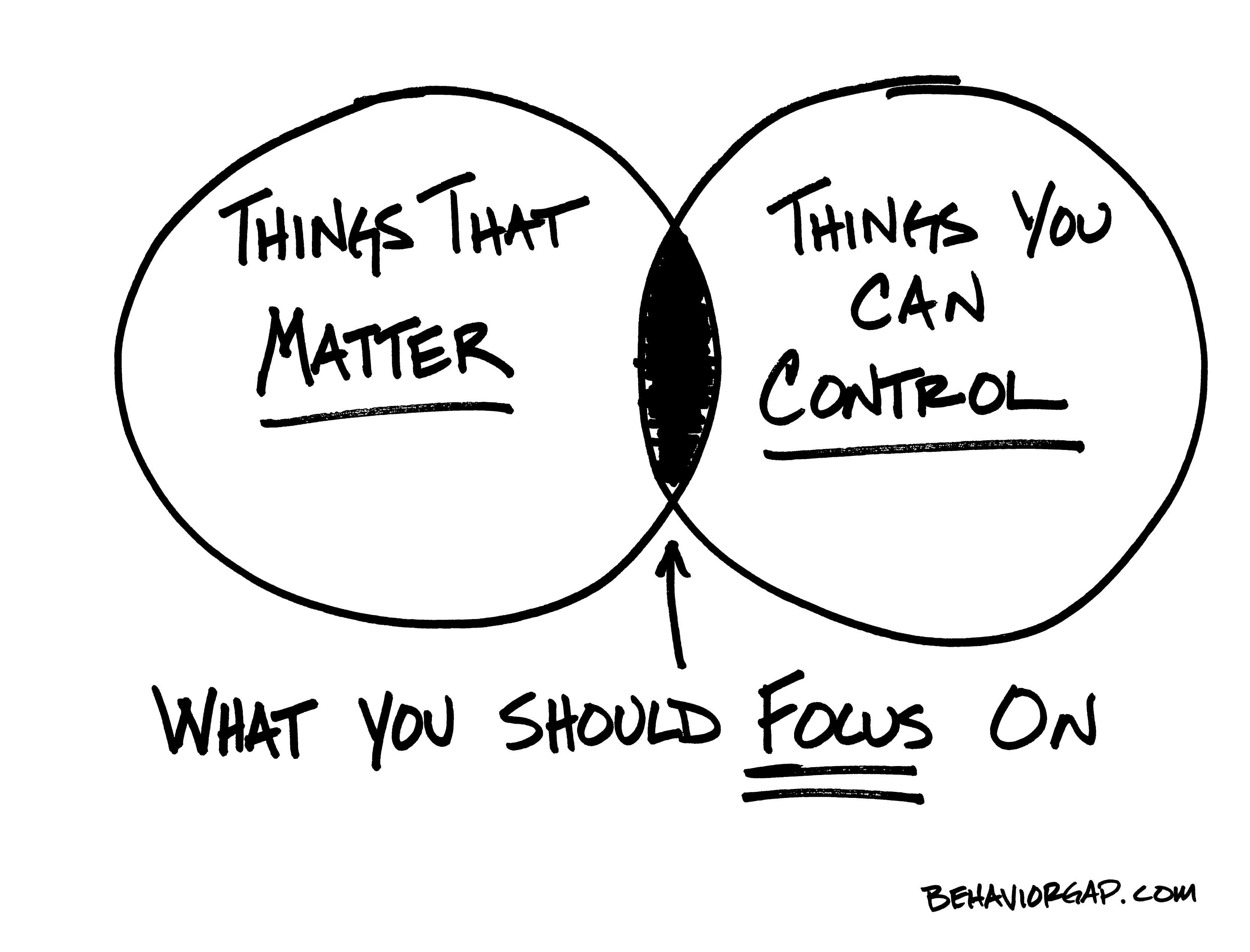

What is the difference between these two sets of questions?

The first set at the top of the page are noise. They are the blather that fills the airwaves and webpages and ink on dead trees. They involve things you can neither predict nor make any sort of intelligent risk/reward decisions about. But the key is they are all things you have precisely zero control over.

The second set of questions have a very significant difference, in that they are things that in your control.

The best advice I give people is stop worrying about what you cannot control, and focus on what is within your power to effect. The rest is noise . . .

Previously:

Things I Don’t Care About (January 15th, 2013)

What Do You Control? (May 30th, 2013)

Source: Carl Richards, BehaviorGap.com

What's been said:

Discussions found on the web: