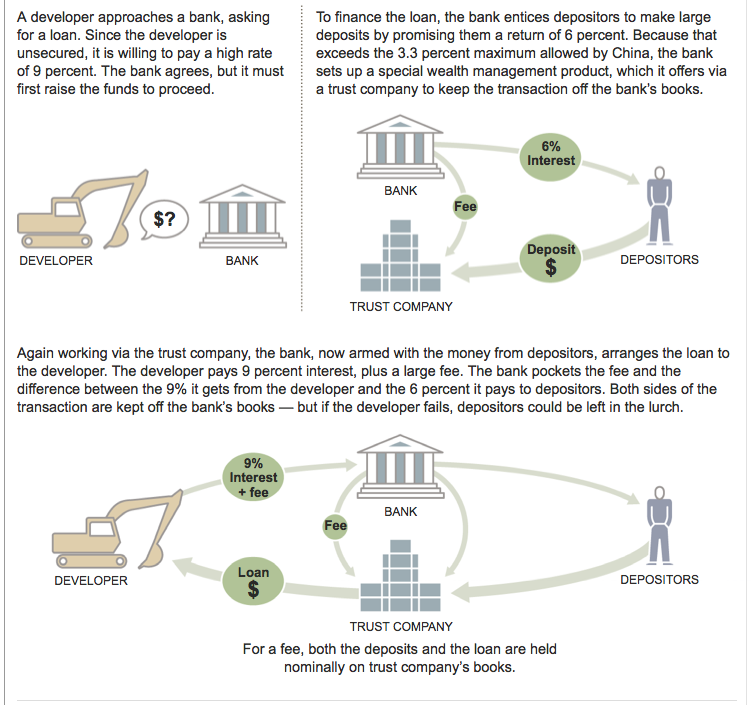

Hey! Its not just the USA that has a crappy shadow banking system — China does too!

click for larger graphic

Source: NYT

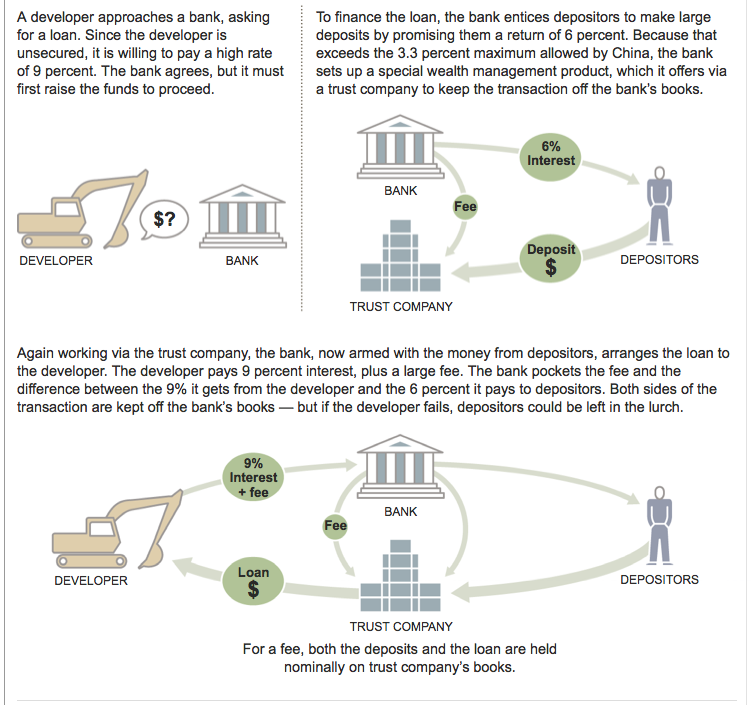

Hey! Its not just the USA that has a crappy shadow banking system — China does too!

click for larger graphic

Source: NYT

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: