click for bigger chart

Source: Bloomberg Briefs

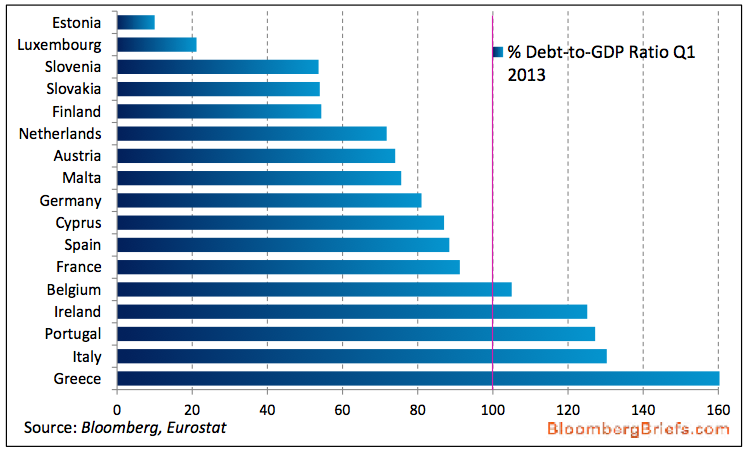

Even as Europe’s stock markets start to awaken, their debt issues continue to worsen. But the correlation may not be significant — the Debt may get worse before it gets better.

Note the wide spread in debt amongst various countries — it is far from uniform.

From an investor’s perspective, the problem is if you wait for the debt problem to clear up, it may be way late for an investment. The bigger moves are made when the general consensus dislikes a given region or theme.

It is rather counter-intuitive, but often the best investable moments are when things look their bleakest.

What's been said:

Discussions found on the web: