This discussion is about probabilities and investor psychology — not predictions.

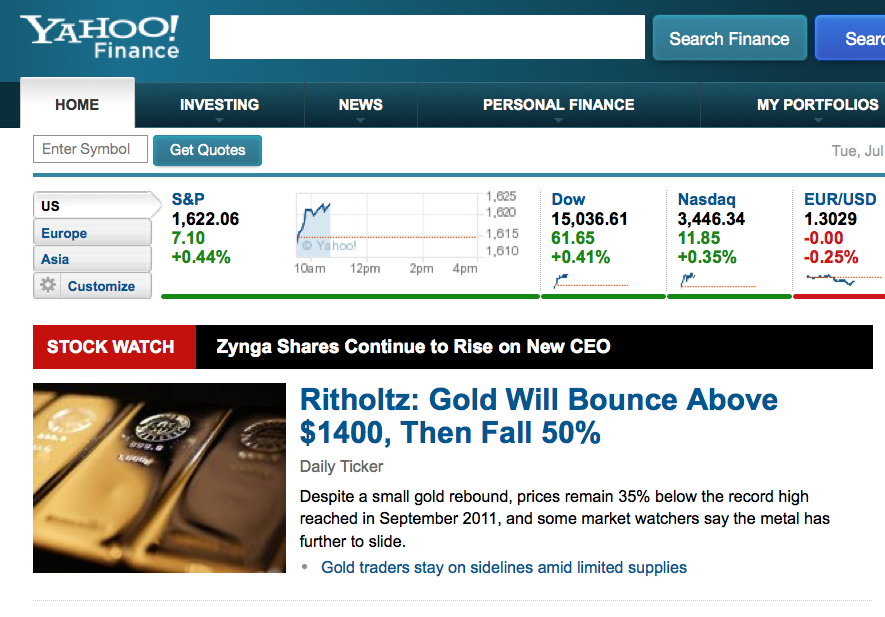

Source: Yahoo Finance

Note: I understand getting heard above the clutter and attracting clicks and all, but this headline is rather different than what we actually discuss on the video above:

What's been said:

Discussions found on the web: