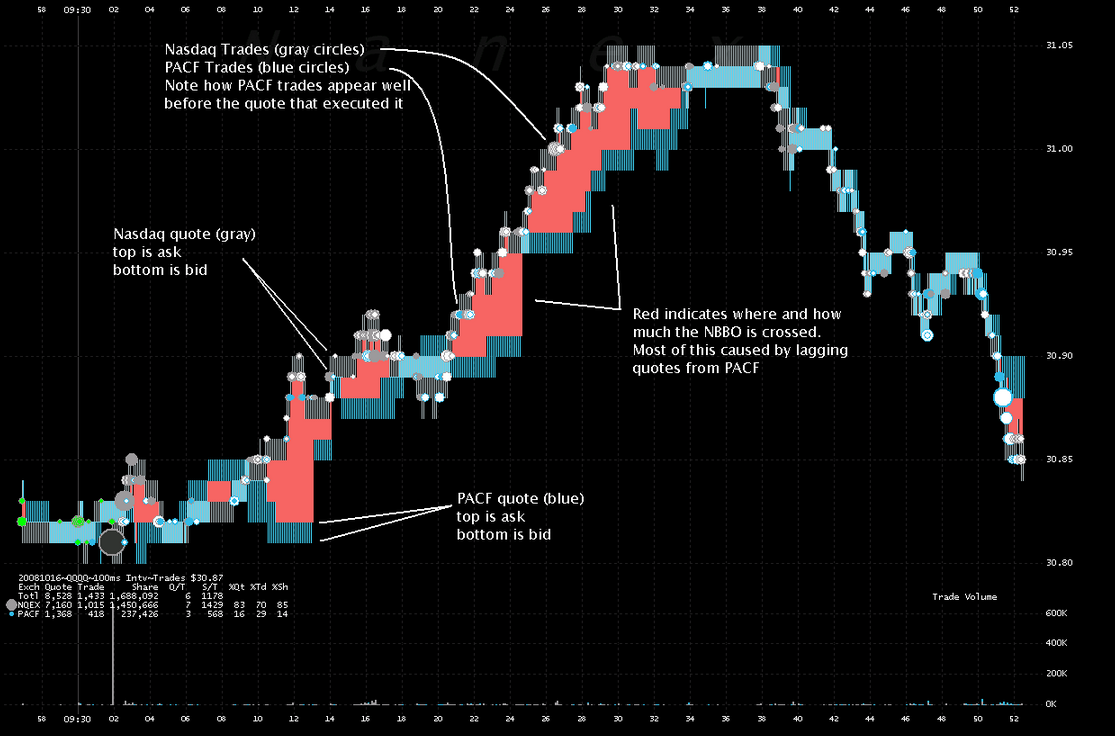

Wherever you see red in the charts below, that’s when HFT received an unfair trading advantage and front ran other traders and investors.

Click through, scroll down a bit, then hit start for samples of HFT front running

Source: Nanex

Nanex observes that:

“Each chart plots trades and quote spreads from Nasdaq and PACF (NY-ARCA) exchanges. The NBBO, when crossed, is shown in red. Note that PACF’s quote (blue) often mirrors Nasdaq’s quote (gray), but is shifted to the right. This is because PACF’s quote was lagging far behind quotes from Nasdaq and other exchanges. Other exchanges are not shown for clarity (charts get cluttered quickly when including all exchanges). PACF’s lagging quote is the source of almost all NBBO crosses in below.

Also note that PACF’s trades almost always line up with Nasdaq trades, and occur before PACF’s quote!

This is solid evidence that High Frequency Traders were illegally receiving core quote information before the consolidated feed, which is exactly what the NYSE was fined for in September 2012.”

What's been said:

Discussions found on the web: