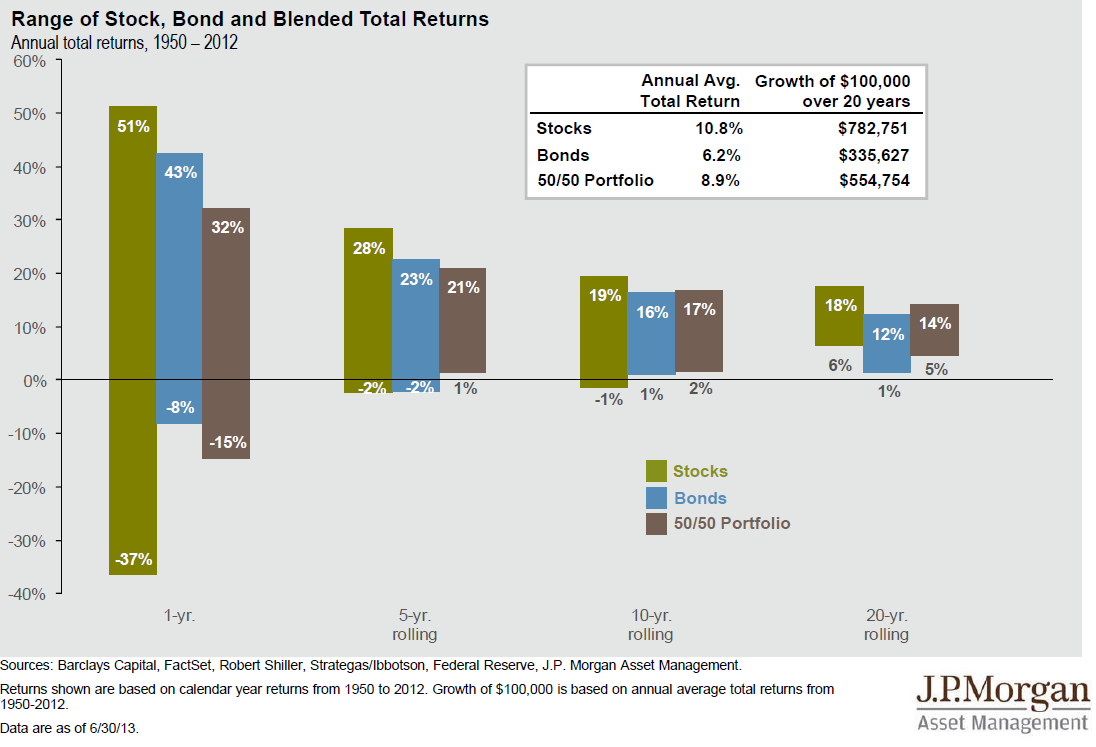

Click to enlarge

Source: J.P. Morgan

I am starting to take a closer look at Equity valuations — but before we do the deep dive into that issue, lets quickly see how different asset classes have returned over various rolling holding periods.

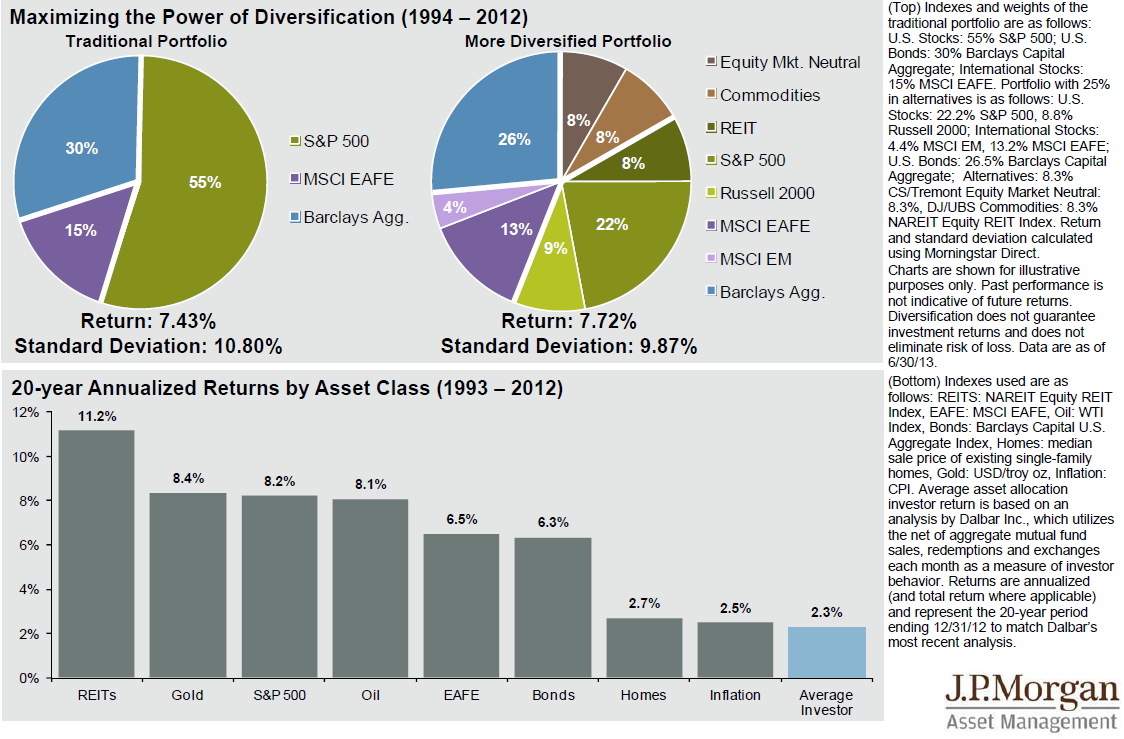

Click to enlarge

Source: J.P. Morgan

What's been said:

Discussions found on the web: