Key data points:

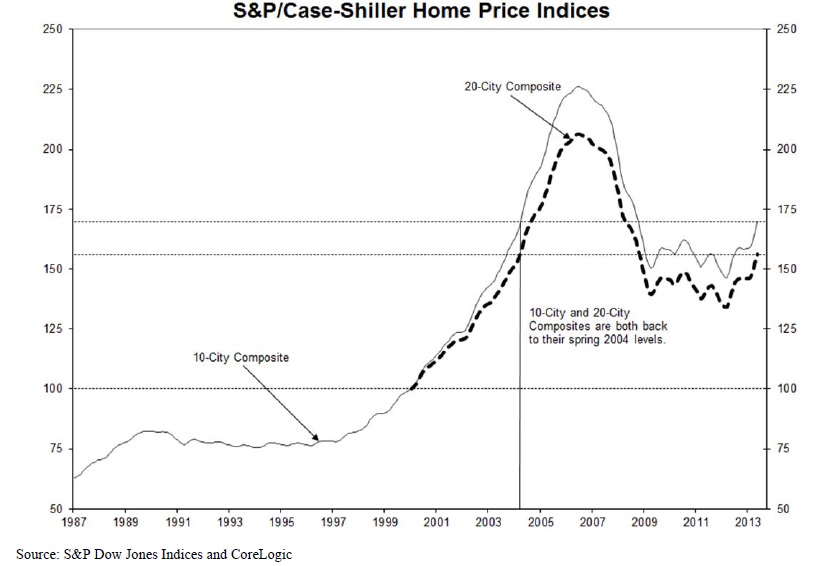

• Home prices show increases of 2.5% and 2.4% for the 10- and 20-City Composites in May versus April.

• Dallas and Denver reached record levels surpassing their pre-financial crisis peaks set in June 2007 and August 2006.

• This is the first time any city has made a new all-time high.

• All 20 cities increased from May 2012 to May 2013 and from April 2013 to May 2013.

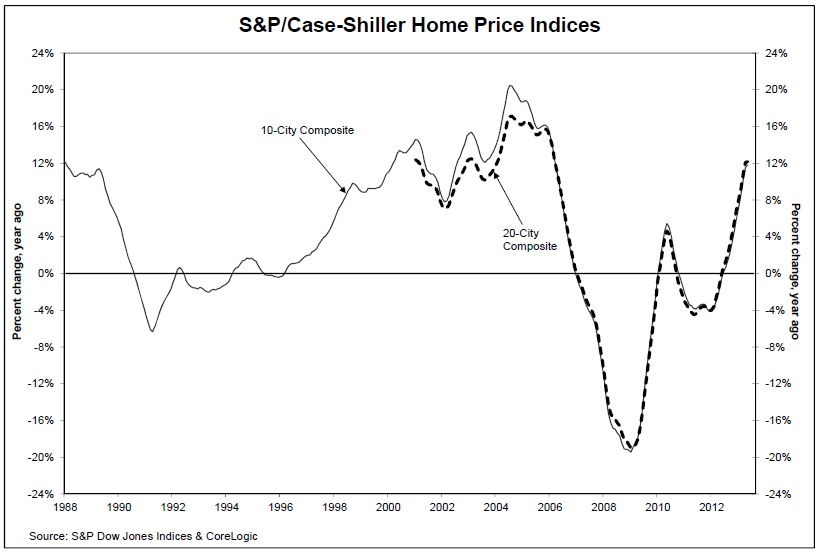

• In May 2013, the 10- and 20-City Composites posted annual increases of 11.8% and 12.2%.

• The Southwest and the West saw the strongest year-over-year gains.

• The overall report points to some shifts among various markets: Washington DC is no longer the standout leader and the eastern Sunbelt cities, Miami and Tampa, are lagging behind their western counterparts.

Click to enlarge

Source: spdji.com

What's been said:

Discussions found on the web: