In the past, we have discussed how worthless the NAR’s Housing Affordability Index is. This weekend saw an odd column in Barron’s that was suckered in by the silliness of that index.

This suggests to me it is time to take another pass showing exactly why this index has so little value to anyone tracking housing values and affordability. let’s begin by going back to our 2008 analysis:

“The index as presently constructed is utterly worthless. It provides little or no insight into how affordable US Housing actually is. Further, what is omitted from the index is especially relevant to the problems occurring in the housing market today. The Index fails to account for — or even recognize — any of the out of the ordinary circumstances that are currently bedeviling the Housing market.”

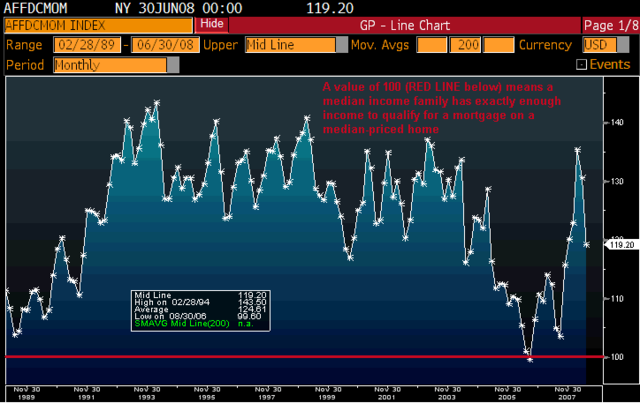

That’s not the worst of it — during the huge run up from 2001-2007, there was but one month — ONLY ONE MONTH! — where the NAR said homes were no affordable!

Only One Month When NAR Said Homes Were Not Affordable

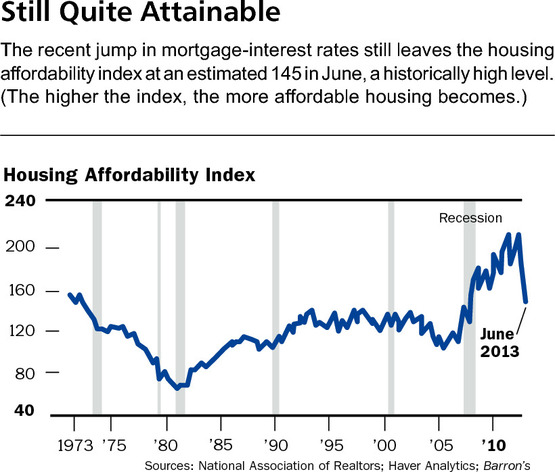

With that absurdity established, let’s look at what The Sunny Side of Higher Interest Rates had to say. Not surprisingly, base don this silly index, they concluded that homes are still very affordable:

“Despite alarms in the media about the crushing effects of the recent jump in interest rates, rates are still on the low side of normal, even when considered against the U.S. economy’s lackluster performance.

Start with the rise in the 30-year mortgage rate, to 4.56% from 3.74% a month ago. The hike still puts the housing affordability index at a historically high level, meaning single-family houses are still quite attainable (see chart below).

Let’s delve a little deeper into what does and does not go into the Home Affordability Index. According to the NAR:

Calculation assumes 20% down payment at current mortgage rates assuming a qualifying income ratio of 25% for PI; no assessment of buyer credit worthiness or total DTI or cash on hand.

So it assumes a down payment. The reality is that about 44% of those homeowners with mortgages have little equity, no equity or negative equity, according to Zillow. This is much higher than historical averages, thus putting this assumption at risk

Hence, this key distinction gets ignored by the NAR in the the way they frame the question and make erroneous assumptions. The issue is not whether homes are affordable, but rather “Can American families afford homes?”

As we have seen, not especially. Indeed, the buyers of many of the properties in recent quarters have not been families, but rather, huge pools of private equity, whose business model seems to be Buy-to-Rent-to-Flip. At the Pew Conference on Housing in DC last summer, attendees at Sheila Bair’s event estimated this pool of PE money was north of $25 billion dollars.

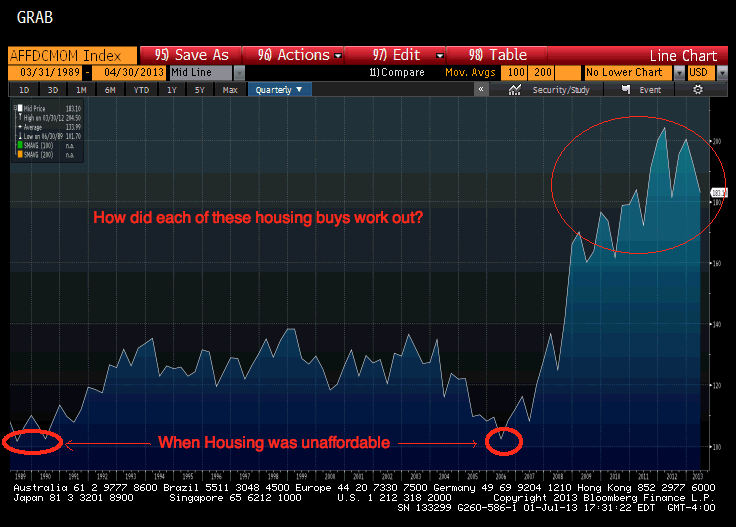

To show you just how ridiculous this datapoint is, let’s take a closer look at the series.

Here is the 10 Year Housing Affordability Index:

When Housing Was and Was Not Affordable

Looking even longer term — 1989 to present – shows just how absurd the index is:

1989 followed a series of rate cuts after 1987 crash. In NYC, if you bought a home then,m you did not get back to break even in the value to ~1996. Bu the home was affordable, just not a good intermediate term investment. And, this was in the midst of an 18 year bull market, with relatively plentiful jobs and credit availability. Same Unaffordable rating for 2006 with very different circumstances.

Should the NAR HAI be renamed? It seems to be better suited to telling you if a house is a good investment than if its affordable!

I still do not take the NAR’s Housing Affordability Index very seriously . . .

Previously:

NAR Housing Affordability Index is Worthless (August 13th, 2008)

Home Affordability Reality Check (April 3rd, 2012)

Source:

The Sunny Side of Higher Interest Rates

Gene Epstein

Barron’s, June 29, 2013

http://online.barrons.com/article/SB50001424052748704382404578565462808909012.html

What's been said:

Discussions found on the web: