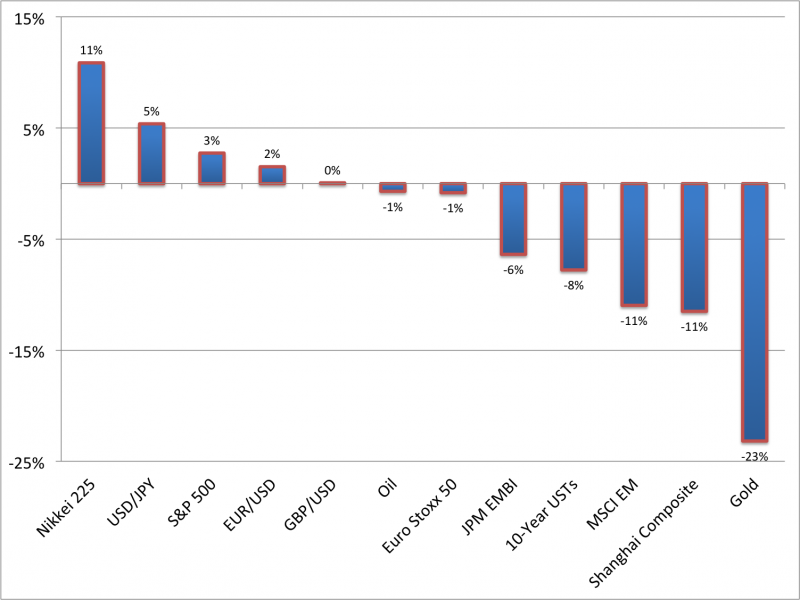

Charts like this make me want to Sell Japan and Buy Gold — at least for a quarter or so.

click for larger chart

Source: Josh Brown

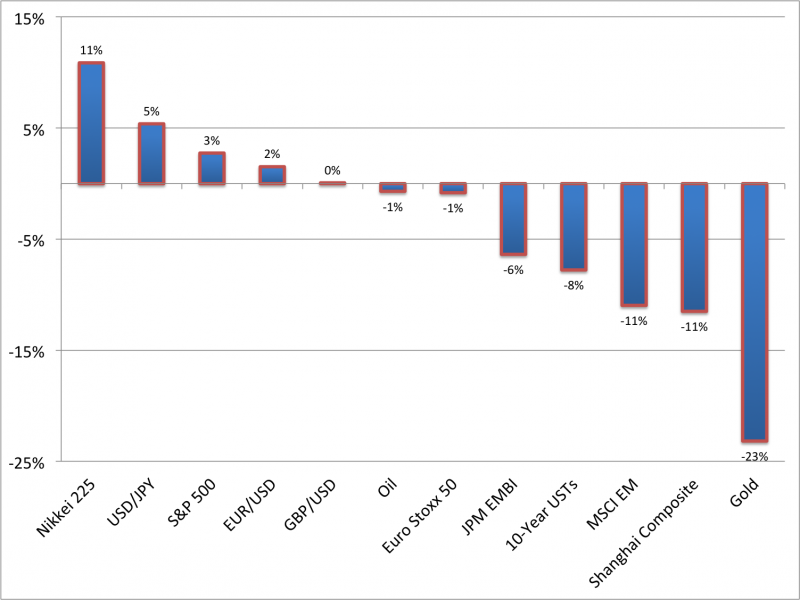

Charts like this make me want to Sell Japan and Buy Gold — at least for a quarter or so.

click for larger chart

Source: Josh Brown

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: