The Irrelevance of Microsoft

Source: (Benedict Evans)

Benedict Evans writes up this very interesting analysis that sums up the entire Ballmer era of Microsoft (MSFT).

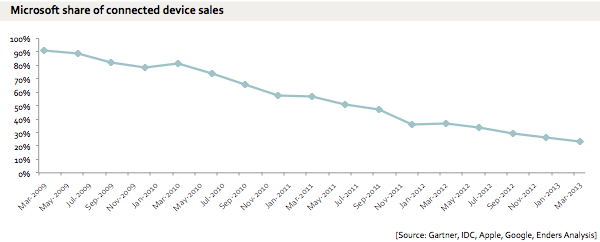

From most of the 1990s and 2000s, the vast majority of connected devices had Microsoft operating systems. Even as late as 2009, their share of connected devices were still over 90%.

Since then, they have fallen to under 25%. This is indeed an astonishing failure of management, innovation and corporate acumen.

They are not quite utterly irrelevant, but they are fast becoming Maytag — a reliable manufacturer of needed if unsexy utilitarian appliance. “Micro$oft’ stopped setting the agenda 18 years ago. Windows 95 was the moment of victory, but was also the peak.

They are not going to go gently into that good night. They still have an enormous cash hoard; their lock on Office keeps them relevant for those of us cannot rely on Google Docs; Lastly, their Desktop OS is still viable, if fading. It may take a decade or more before the desktop Windows as we know it disappears, replaced with who knows what?

To quote Evans, “an overnight collapse can take a long time.”

Here is the question for investors — I don’t know the answer to this — how much Microsoft would you be willing to buy and put away for a decade? You can’t tough it for that entire period. What about Apple (AAPL)? Google (GOOG)? Something else?

~~~

Go read Benedict Evan’s full piece here.

What's been said:

Discussions found on the web: