My morning travelin’ reads:

• China Stocks World’s Worst Losing $748 Billion on Slump (Bloomberg) see also Misreading Chinese Rebalancing (Project Syndicate)

• The Pros and Cons of Stock Buybacks (WSJ)

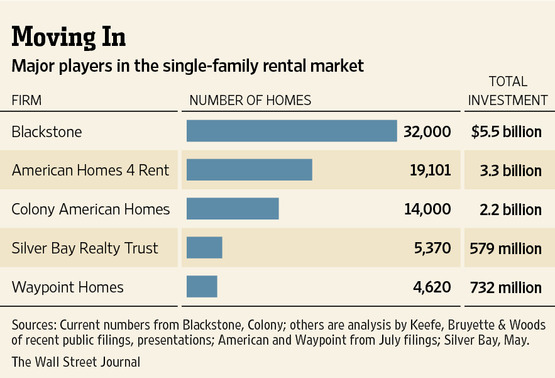

• Blackstone, Deutsche Bank in Talks to Sell Bond Backed by Home Rentals (WSJ)

• Forward Earnings Flying High (Dr. Ed’s Blog)

• Relax, We’re Not Detroit (The Daily Beast) see also After Detroit, muni bonds are safe, but no slam dunk (Reuters)

• American Dream Slipping as Homeownership at 18-Year Low (Bloomberg)

• In Europe, the case for… optimism? (FT Alphaville) see also A Marshall Plan for Greece (Reuters)

• 10 Signs That US Infrastructure Is A Disaster (Business Insider)

• Mobile Makes Facebook Just an App; That’s Great News (Stratechery)

• Apple’s iTunes Reaches One Billion Podcast Subscriptions (Small Business Trends)

What are you reading?

Blackstone/DB in Talks to Sell Bond Backed by Home Rentals

Source: WSJ

What's been said:

Discussions found on the web: